2025 was a banner year for the European space industry, so how does one sum it up into a single story? By taking the easy route.

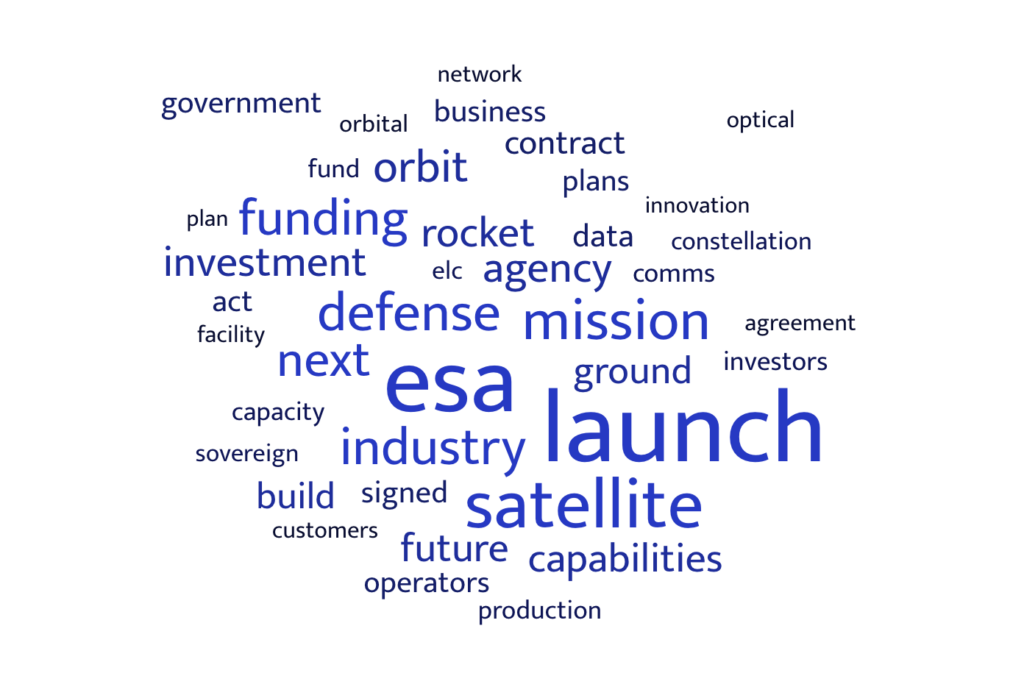

We built a word cloud based on the 100+ stories Payload ran on the European space industry this year, and one theme jumped out immediately: a lot of forward-looking language.

Words like “plan,” “capacity,” “investment,” and “build” were featured repeatedly in our coverage. The major stories seemed to focus not on the here-and-now, but on the implications for the rest of the decade. No matter how you look at it, 2025 was a building year for the ecosystem.

Looking back: Examples are all over the archive.

- National defense ministries, including Germany and France, restructured their investments to focus more heavily on space-based capabilities.

- Multiple satellite and component manufacturers invested in ramping up their production outputs.

- The European Commission initiated a rewrite of regional space laws to better promote the industry—though whether the EU Space Act in its current form accomplishes this feat is up for debate.

Even when things went wrong—such as when the launch timelines of new rocket companies slipped, or when geopolitical tensions created a rift across the Atlantic—the focus turned back to the future. Europe signed more partnerships with the international community, and reiterated its commitment to deep space projects, including the Artemis program.

Time and again, sources described to Payload how their decisions were made with an eye toward growth, resiliency, and self-reliance. Perhaps more surprising: most of the continent seemed to be on the same page, for once.

In March, ESA released its Strategy 2040 document, which called for a boost in funding to meet its long-term goals. Then, in November, the agency secured record funding for its next three years of operations—and 24 of 27 countries increased their contribution, some staggeringly so.

The increase in ESA funds echoed a similar uptick in private funds being funneled into space startups—a metric investors believe will only increase. The growth in public and private funds was due to the widespread recognition that space is vital to the modern age. However, there was also a tone change in the perception of dual-use tech, and companies felt more comfortable than ever speaking to investors about the defense implications of their technologies—and were rewarded for doing so.

Beginners luck: 2025 was also a year of firsts, with multiple demo missions opening the door for new capabilities in the years to come.

- In launch, Isar Aerospace lifted off the pad at Norway’s Andøya spaceport for the first time, flying briefly before crash-landing in the sea.

- In communications, OQ Technology said it sent Europe’s first D2D emergency alert, opening the door for mainstream D2D comms, and Open Cosmos launched its 6GStarLab satellite to study the next-gen comms tech.

- Public and private investors backed a range of companies developing optical or quantum communications technology, with funds going to Cailabs, Astrolight, and Thales Alenia Space, to name a few.

- In reentry, both ATMOS Space Cargo and The Exploration Company flew demonstration launch-and-return flights.

- In EO, European defense forces started buying more services and dedicated satellites, from companies like ICEYE and NanoAvionics.

The bottom line: While there was a lot to celebrate in 2025, the work is only just beginning. Companies, national governments, and investors are betting big on the future of the European space industry, and now the challenge will be to keep up the momentum.