After nearly a decade of steady growth in venture capital investment into space startups, the market sentiment seemed to cool down in the aftermath of the pandemic.

Investors at the ISS Research and Development Conference conference in Boston Wednesday shared how their investment strategies are adapting to new technologies and shifting market conditions in LEO.

“[W]hat generally happens with new technologies and new markets: people get ahead of themselves, and this is what we saw in ’20 and ’21,” said Mislav Tolusic, chief investment officer of Marlinspike Partners.

Some startups over this timeframe were trying to generate extra profits by simply taking a terrestrial business model or technology and sticking it in space, Tolusic explained.

Network effects: As access to LEO has increased, the number of objects in orbit has grown exponentially, which has driven even more growth in the number of businesses that can make money in the industry.

“Even if we see anywhere near that 10x of satellites that are predicted, there’s a lot of need for additional resourcing—for servicing, for maintenance—and then we start to really see some of the real economy effects there,” Starburst Aerospace’s managing director Elizabeth Reynolds said.

This situation may compound when ISS deorbits in the early 2030s and the US government’s $3B a year spending on the program is directed toward commercial space stations.

“Seeing those first [commercial space stations] go into space will be good for the market. [They’ll] be platforms and infrastructure that’s very much needed for a lot of the downstream businesses here,” said Generation Space VP Lewis Jones.

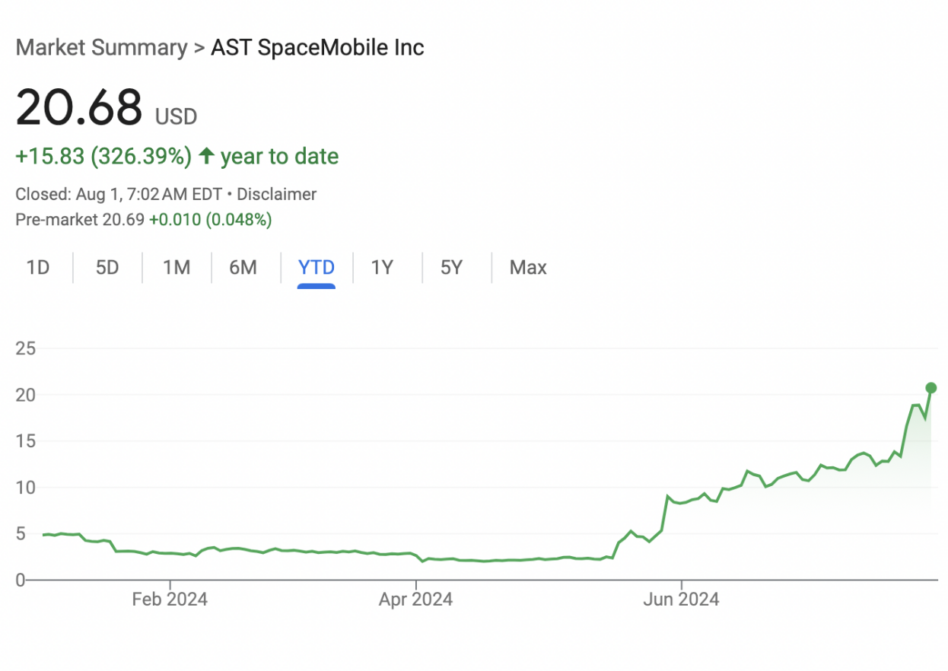

The exit ramp: Given that many of the space SPAC’s in 2020 and 2021 went poorly, IPOs may be less attractive to startups and investors alike, especially given the amount of disclosure that typical IPOs require.

Selling to a strategic investor or into secondary markets may prove to be the preferred exit strategy for space startups going forward.

“In private markets a lot of those problems go away. So, there’s a legitimate question: why should I ever go public? So that secondary option is going to be something that down the road we’re going to be exercising a lot more,” Tolusic said.