Dish Reports Q4 2022 Earnings:

Yesterday, Dish ($DISH) reported that Q4 net income increased to $936M, a substantial rise from $552M in the prior year. The revenue story was not as bright: Dish generated $4.04B in Q4 sales, down 9% from the prior year.

The culprit for revenue declines is a lower subscription base across all products. In the fourth quarter, total TV subscribers declined by 268,000 to 9.75M. Satellite TV lost 191,000 subscribers, while Sling TV (a streaming service) lost 77,000 over the same period. The respective services finished the year with 7.4M and 2.3M subs, respectively.

- Meanwhile, on the telecommunications front, Boost Mobile lost 24,000 subscribers and finished Q4 with 8M subs.

Dish has struggled to gain footing in its two product markets as the company faces headwinds in both cord-cutting and 5G network markets. As a result, $DISH shares are down 50% in the last year. Despite these headwinds, investors welcomed yesterday’s news of increased profitability. $DISH missed on revenue but beat on earnings. The stock closed up 5.20% on the day.

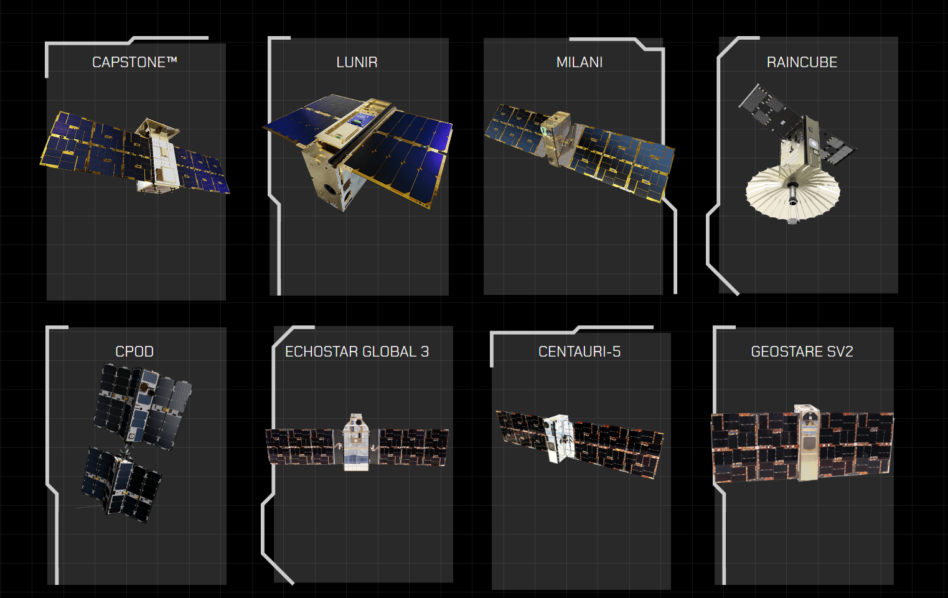

EchoStar Reports Q4 2022 Earnings:

EchoStar ($SATS), the company behind Hughes satellite internet, also announced earnings yesterday. The Q4 results:

- Revenue was $500M, which is flat YoY.

- Net Income was $47.6M, compared to -$80.1M in Q4 of 2021.

- Hughes satellite network had 1.2M subscribers, losing 57,000 customers in Q4.

The competition: The Hughes GEO satellite network is facing a stiffer challenge from the lower ground (aka LEO). In 2022, Starlink grew to 1M subscribers—and will likely pass Hughes soon. EchoStar management has conceded that a portion of that growth was due to customers who switched over from Hughes.

Mix shift: Hughes now derives 42% of sales from enterprise customers, up from 35% last year. Since enterprise clients are generally stickier than the consumer market, the mix shift could help stabilize subscription churn going forward.

+ Stock pulse check: $SATS beat expectations on both revenue and EPS, sending the stock up 13.50% on the day.