Thales Alenia Space cut the ribbon on a €100M satellite manufacturing facility in Rome this week, funded by the Italian Space Agency (ASI) with “substantial” investment from France’s Thales and Italy’s Leonardo.

The new facility will be capable of producing 100+ 300 kg class satellites annually, vastly increasing Europe’s total production capacity for new, next-generation satellites.

Anotha one: The Space Smart Factory is the latest in a series of shiny new production hubs across the continent, as European space agencies, satellite manufacturers, and parts suppliers have spent 2025 pouring capital and concrete to boost their sovereign, high-skilled manufacturing capacities.

- Last month, Planet Labs announced plans to build a new production facility outside of Berlin, an investment which will “exceed 8 figures” and is expected to double the overall production capacity of the birds that make up Planet’s Pelican satellite fleet.

- In August, Aerospacelab closed a €94M Series B to complete the construction of its Belgian Megafactory, which is expected to come online next year and be capable of producing up to 500 satellites annually.

- In May, Endurosat raised €43M to construct a new manufacturing and test facility in Sofia, Bulgaria that aims to churn out up to 60 sats a month.

- In March, SITAEL cut the ribbon on its “Space Factory 4.0,” which is developing a range of satellites for ASI, NASA, ESA, and Italy’s iRIDE constellation.

Sats of a feather: Since the start of the decade, the European space industry has invested hundreds of millions of Euros to build up the continent’s satellite manufacturing capacity, and the region will soon have the collective potential to produce hundreds of sats per year—if not thousands.

These investments by prime manufacturers have led to countless new jobs in the industry, and spurred further manufacturing commitments across the supplier community.

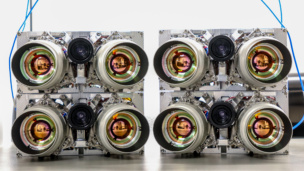

Recently, multiple companies developing optical communications technologies have invested in their own production facilities to keep pace with prime satellite manufacturers who have signaled their growing interest in laser comms.

- Last month, MBRYONICS—the Irish optical comms tech startup—announced a new facility in Dangan, Ireland to begin large-scale production of optical communications terminals, with a targeted capacity of 500 annually.

- At the same time, Cailabs announced a €57M fundraise to quintuple the production capacity of its ground station tech with the investment of a new facility in France.

- Last year, TESAT opened a German facility producing laser terminals, and the company won a contract in May to produce 792 terminals for MDA Space.

The bottom line: Taken together, these announcements make it clear that Europe is on the path to creating a robust space manufacturing sector. The next obvious step is to stand up the region’s launch capabilities, so the growing pool of satellites can get to orbit without having to cross the Atlantic first.