SynMax, a satellite data analytics company building products to monitor industrial assets and dark ships around the globe, has raised a $13M round of funding as it eyes new markets for its analysis platforms.

The round was led by Bill Perkins, an energy trader and cofounder of SkyFi, and also included participation from Palantir cofounder Alex Moore and a slate of SynMax customers. The company priced the round at a $50M pre-money valuation.

SynMax 101: Though the foundation for SynMax’s product starts with images collected by satellites, that’s far from where it ends. The company relies on commercial satellite imagery to draw unique insights on high-value industries and deliver actionable analytics directly to end customers. It’s the end-of-the-chain piece of the EO market that SynMax CTO Eric Anderson believes is essential for the segment to be successful.

“We need companies to pick up the imagery once it gets downloaded and actually turn it into actionable intelligence,” Anderson said. “That is a whole other effort that’s going to require a whole other piece of the value chain.”

The company currently offers three products:

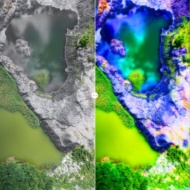

- Hyperion, which pulled in ~$3M ARR in 2023, is the company’s biggest earner to date. The product uses a detection algorithm on satellite images from Planet to deliver customers detailed information about oil and gas reserves.

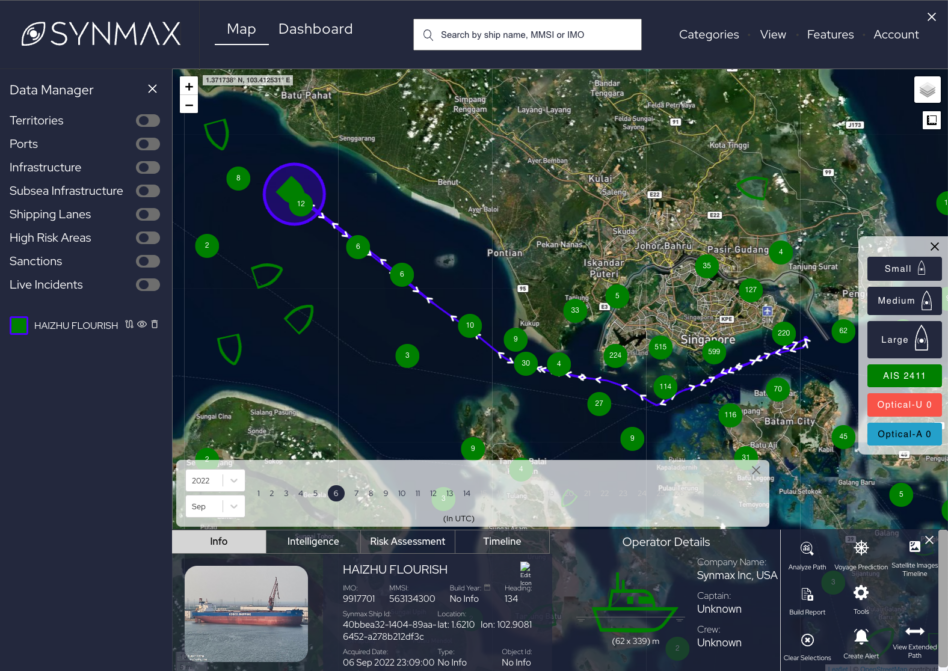

- Theia earned ~$2M ARR last year. Theia serves primarily government customers, and analyzes ocean imagery from Planet to identify dark vessels, i.e., ships that have switched off their voluntary detection systems for whatever reason.

- Vulcan, the newest of the crew, is currently engaging with preliminary customers interested in data on the capacity and predicted outputs of coal plants. It’s drawing from BlackSky imagery to make those insights.

The company currently employs 40+ people, primarily focused in technology development for the suite of analytics products. Three of those employees handle the company’s business development.

The road ahead: First on SynMax’s list of priorities for growth is expanding the markets it serves with its data. Much of the funding raised in this round will go toward hiring and scaling the business team in order to reach new customers—particularly in the energy industry.

The analysis algorithms are getting an upgrade, too. Anderson said that the company hopes to build out Hyperion, which currently goes deep into the supply side of the equation, to use what it’s learned about tracking the movement of oil and gas to generate insights on the demand side.

“As we move to different generation sources, and as we complicate our energy infrastructure, the way to deal with that volatility is with better information,” Anderson said. “What we’re trying to do is create more definite and actionable datasets on what’s happening with that infrastructure.”