Orbiter’s inaugural SN1 mission is nearly ready to fly. The satellite transfer vehicle and payload-hosting platform will launch on a Transporter-6 rideshare this October. Hawthorne, CA-based Launcher announced customers this morning:

- Orbiter will deploy craft for Skyline Celestial, Innova Space, NPC Spacemind, Bronco Space/Cal Poly Pomona, a Stanford student-run organization, and an undisclosed customer…

- …and host payloads for CesiumAstro, yet another undisclosed customer, Beyond Burials, and TRL11.

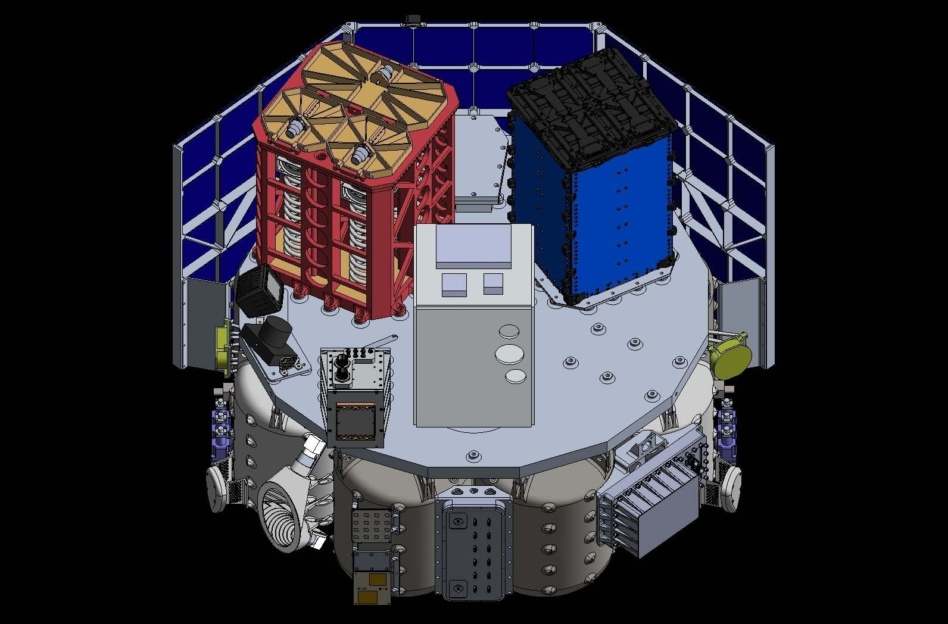

Orbiter specs

- Mass of 200 kg, payload capacity of 400 kg, and propulsive capability of 500 m/s delta-V.

- Mission lifetime of “2+ years.”

- Orbiter can conduct altitude, plane, and inclination changes, along with in-plane phasing.

- A dedicated ride costs $400,000, plus $1M+ in associated launch costs. Rideshare costs $8,000–$25,000/kg, inclusive of launch.

- Launcher’s tagline for the vehicle: “Anywhere in space, at the lowest price.”

Orbiter SN2, SN3, and SN4 are set to launch in January, April, and October 2023. Launcher is still selling capacity for all three missions, along with SN5 (slated for Q1 ‘24). Each manifested Orbiter mission will launch with Falcon 9.

Big picture: The time of space tugs (or orbital transfer vehicles, or OTVs) may be upon us. Beyond Launcher bringing Orbiter to market as its first product, there’s plenty more happening in this space. To wit:

- D-Orbit’s ION vehicle has flown five missions and recently claimed an on-orbit propulsive maneuvering first. By all appearances, the Italian startup’s SPAC merger with $BREZ is still a go.

- Momentus ($MNTS) is set to launch its first Vigoride OTV this month or in early June on Transporter-5.

- On the earlier-stage side, Momentus’s fellow Y Combinator alumni Turion and TransAstra (both YC S21) are developing the Droid de-orbiter and Apis transfer vehicle.

Note: Payload asked Launcher CEO Max Haot a couple questions and received his answers after publication. We’ve updated the story with his comments below.

Why did you (Launcher) decide to bring Orbiter to market before Light? [Note: Light = Launcher’s rocket under development.] What factors went into the decision?

Our market view is that customers are only buying dedicated small launch vehicles, such as Rocket Lab Electron, if they cannot achieve their mission objective on SpaceX rideshare. The latter is 10x lower cost-per-kg than Electron, the leading small launch vehicle. It is also readily available at short notice, very reliable, and has friendly rebooking terms. This view is shared by our customers but is contrarian to what the small launch companies are promoting.

In our view, dedicated small satellite launch from the ground will always be higher cost than a large rideshare bus ride, even though there’s room to optimize and reduce this 10x price difference, as we plan to do with Launcher Light. So we built a strategy aligned with our customers and SpaceX. We’re first trying to accomplish our customer’s mission with SpaceX rideshare and Orbiter, the most economical option.

We only offer Launcher Light, our small rocket flying from 2024 on, if the mission cannot be achieved on SpaceX rideshare due to schedule, privacy needs, or the target orbit being out of reach for Orbiter’s 500 m/s propulsive capability. We were developing Orbiter in any case as part of Launcher Light’s third stage and we reached out to SpaceX in Q1 2021 to inquire if they would fly Orbiter on their rideshare. They were excited to welcome us as a new US-designed and -produced space tug, so it confirmed the strategy made sense and we proceeded full speed.