The face of space-based solar power (SBSP) is changing due to surging interest in in-space industry and data centers. While some companies are racing toward these new opportunities, others are sticking with the technology’s original goal of powering life on Earth.

“Using space for power purposes has fundamentally changed, just in the past few years. It went from pie-in-the-sky science fiction…to now, when there’s not only a resurgence of interest in beaming power down to the ground from space, but now putting the actual load up in space,” Marc Berte, founder and CEO of space solar startup Overview Energy, told Payload.

Some of the largest US tech companies are exploring space-based data centers.

- Google announced in November that it was working with Planet Labs on a space data center project, with aims to launch satellites in 2027 carrying Google’s specialized computer chips into orbit;

- SpaceX plans to use an upgraded version of its Starlink satellites to host AI computing payloads, according to CEO Elon Musk;

- Blue Origin has had a team working for more than a year on tech needed for orbital AI data centers, according to reporting from The Wall Street Journal.

The SBSP challenge. The space industry is all in on space-based data centers, manufacturing in orbit, and permanent lunar installations—but someone has to keep the lights on. The rise of these missions has expanded the customer base for SBSP, providing new use cases that could change the nascent industry’s path to reality.

Industry experts and entrepreneurs say the vision of providing SBSP to support Earth’s baseline needs is still alive and well, though that vision may have hit some roadblocks in the last two years. Hype around government-funded explorations of the technology dimmed slightly, though it didn’t go out.

While SBSP’s journey to reality could take some unexpected turns through data centers and lunar colonies, experts said, the business case remains the same: Powering industry on Earth is hard, so let’s get off the planet.

Moving demand to supply

The sun always shines in space. That’s the idea underlying SBSP, which proponents say will. overcome the limitations of terrestrial power grids. Beaming power down from orbit can also overcome some of the congestion and transmission challenges posed by traditional power grids. In the last year, that argument has moved one step further: why not move the energy consumption into orbit as well?

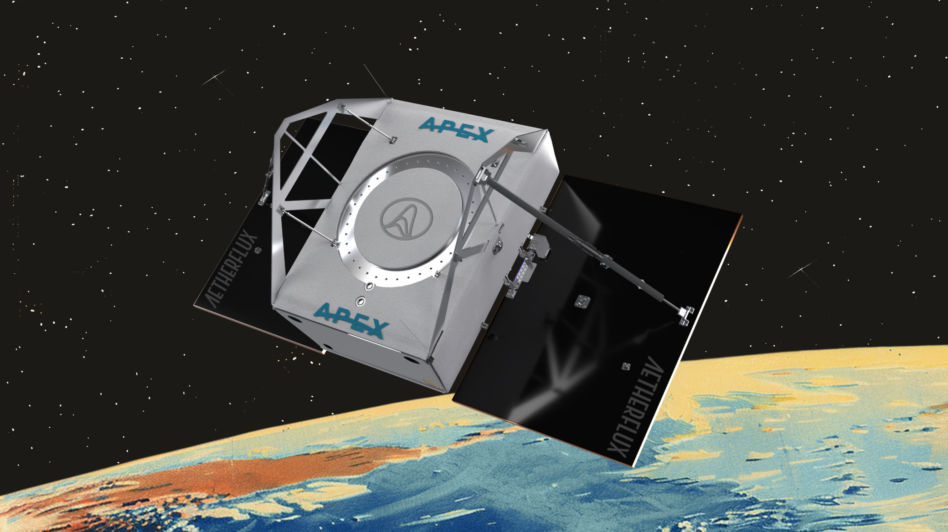

From the ground up: Emerging from stealth in 2023, Aetherflux has focused on a set of use cases outside the traditionally imagined space-to-Earth grid application of space solar.

Aetherflux is pursuing contracts with DoD to beam power for remote installations—using a constellation of orbital data centers called the “Galactic Brain”—and exploring wireless energy transmission concepts for prospective lunar settlements.

Aetherflux describes the Galactic Brain as a network of processor-hosting satellites powered by unceasing solar energy in space. Aetherflux COO Joseph Yaffe says the company doesn’t view SpaceX as a direct competitor, as Aetherflux’s satellites will be larger and fewer, compared with the compute-enabled Starlink system Musk has described.

“We are developing a more tightly engineered, interconnected set of GPUs on a single satellite with more of them per launch, rather than a number of launches of smaller satellites,” Yaffe said.

The technology underpinning that ambition, Yaffe said, is Aetherflux’s proprietary laser system, which can beam data between Earth and its orbital GPUs.

To the Moon: That same tech could form the basis of a lunar energy system, which is part of a concept Aetherflux is exploring with Lockheed Martin in response to an RFP NASA put out for a fission surface power project. The space agency asked industry to propose concepts for a permanent nuclear fission installation on the Moon. Lockheed tapped Aetherflux to design power-transmission techniques to transmit across the lunar surface and to satellites.

“It’s leveraging the technology that we’ve already developed—which is sophisticated pointing, acquisition, and tracking technology—to put laser beams on a precise spot and beam power through those lasers across long distances,” Yaffe said.

Aetherflux sees a handful of niche customers on Earth, but large-scale generation for grid-scale use isn’t at the forefront of their plans. Aetherflux instead hopes to beam solar power from space to remote customers such as isolated military installations, mines, and offshore oil rigs.

Defense needs: Aetherflux received a $9M grant from DoD’s operational energy capability improvement fund, in partnership with the Air Force, to develop a proof of concept demonstrating wireless power transmission from LEO to Earth. The company is planning a demonstration of its space-to-Earth energy beaming technology in June, when it will send power from LEO to a receiver in White Sands, NM.

“I think it’s fair to say the interest is high. There are going to be a lot of eyes on this demonstration,” Yaffe said.

Hushed, But Alive

Hype around space solar power for grid-scale applications on Earth has quieted in the last two years, but some countries and startups are pushing ahead.

Years of dropping launch costs, technological advances, and the growing need for a clean source of baseload power prompted a spurt of space solar research among national space agencies in 2023 and 2024.

- ESA launched its SOLARIS program in 2022, designed to investigate space solar as a pathway to achieving net-zero emissions.

- Japan and China also ramped up national efforts to create large-scale solar power generation in space.

That was before NASA released a January 2024 study that seemed to pour cold water on the concept of large-scale space solar. The study projected that two space solar design concepts would incur baseline lifecycle costs of $610 and $1,590 per megawatt-hour (2022 dollars), respectively, in a period from 2050 to 2080. The cost model theoretically makes SBSP systems 12 to 80 times more expensive than projections for terrestrial renewable alternatives.

The cost debate. Many advocates and industry insiders agree that the report was excessively pessimistic, overestimating launch and maintenance costs—the study assumed $1,500-per-kilogram launch costs, and 10-year hardware lifetimes. The NASA study acknowledged that space solar could become directly competitive with terrestrial alternatives ($40-$80 per megawatt-hour) if launch costs drop to $500 per kg, hardware lifetimes extend to 15 years, and manufacturing learning curves achieve 85% or lower.

Still, NASA hasn’t made much effort to investigate SBSP further, and some other jurisdictions have been quiet about their plans in the wake of the release..

- EU: ESA has been conspicuously quiet on whether it would continue its exploration of the technology in 2026. ESA initially promised it would announce in late 2025 whether it would continue studying SBSP, but last year ended with no announcement.

- China: A planned demonstration of the technology was also absent from China’s 15th five-ear plan, released in October. Chinese scientists associated with the project, however, stated that same month that the project was going forward. The project was akin to “moving the Three Gorges Dam to a geostationary orbit,” Long Lehao, a senior scientist and a member of the Chinese Academy of Engineering, said in November.

- Japan: The only country still openly pursuing SBSP is Japan, where space solar is a long-term R&D target under the national government’s basic energy plan. JAXA and Japan’s Ministry of Economy, Trade, and Industry are sponsoring a small-scale tech flight demo sometime in FY 2026, aiming to become the first project to deliver solar power from space to Earth and convert SBSP into usable electricity.

- The OHISAMA satellite will light an LED by delivering a modest 720 watts to a parabolic antenna at JAXA’s Usuda Deep Space Center.

- Project leaders already executed a successful wireless power transmission test in 2024 from an aircraft, at an altitude of 7 km.

A commercial pivot: John Mankins, a former NASA and JPL scientist and long-time space solar advocate, doesn’t see some space agencies seemingly abandoning the idea as a long-term slowdown. Mankins argued that ESA based its examination on particularly difficult design concepts for SBSP, and pointed to the “worst-case” assumptions in NASA’s 2024 report.

ESA’s and NASA’s retreats “have weakened support among policy leaders,” Mankins said. “Now, having said that, there are a number of startups in the US, Australia, the UK, and China. All of them are interested in space solar.”

For Overview Energy’s Berte, who is running one of those startups, the possibility of SBSP for large-scale terrestrial use is a game of scale.

“There are [power] loads like orbital data centers that you can put in space, whether or not it’s economically effective to do so, but then there are also loads you can’t put in space, which includes almost every other human activity,” Berte said.

SBSP at a massive space scale

When he spoke with Payload in February, Berte was in Austin, TX, on a fundraising tour. The startup already raised $20M in a seed round led by Lowercarbon Capital, Prime Movers Lab, and Engine Ventures, and is now working on raising a Series A, as reported by Heatmap.

Overview plans to build a constellation of hundreds of thousands of satellites in GEO, where the craft can beam power to a broader array of locations. Berte envisions each satellite providing power to multiple terrestrial regions, using existing solar fields as receivers for the beamed energy. The power would be flexible as energy needs fluctuate with demand, based on times of day.

Seeking the niche: Both Overview and Aetherflux see initial interest from a limited set of niche customers—remote island communities, mines, hyperscalers—but the company predicts demand will grow as costs come down.

“That’s a great cycle to be on, because it means the more customers you get today, the more customers you can get tomorrow,” Overview’s Berte said.

The company has been negotiating capacity agreements with prospective customers, in which power users would pay to enter a queue for future space solar power.

- Overview signed an MOU with Saudi electricity giant Acwa Power in late January, aiming to explore applications of SBSP for desalination, hydrogen production, and utility-scale power generation.

- Overview also completed a successful flight demo of its power-beaming technology from an airplane in November.

“Overview was built around being a manufacturing and scalability play, as opposed to being a technology-development play,” Berte said. “It’s a matter of investment scale, in terms of how fast that goes.”

For Mankins, the niche-use markets that companies like Aetherflux are pursuing don’t represent a threat or deviation from the long-term vision of space solar for Earth’s grids. Instead, those visions could accelerate the advent of space solar for broader terrestrial use, serving as “pathways” to a widespread orbital power infrastructure.

“Because of the potential use on the Moon, because of the potential for orbital AI data centers, I think it could possibly be within five years that we see [SBSP] on Earth,” Mankins said.