Rocket Lab ($RKLB) booked $40.7M in Q1 revenue, which represents a 124% annual jump and quarterly growth of 48%. Net loss widened in Q1, growing ~71% YoY to $26.7M.

End-to-end space: The rocket company is executing on its strategy of building out a robust non-rocket business. Rocket Lab’s space systems unit generated $34.1M in Q1, good for ~84% of Q1 revenue.

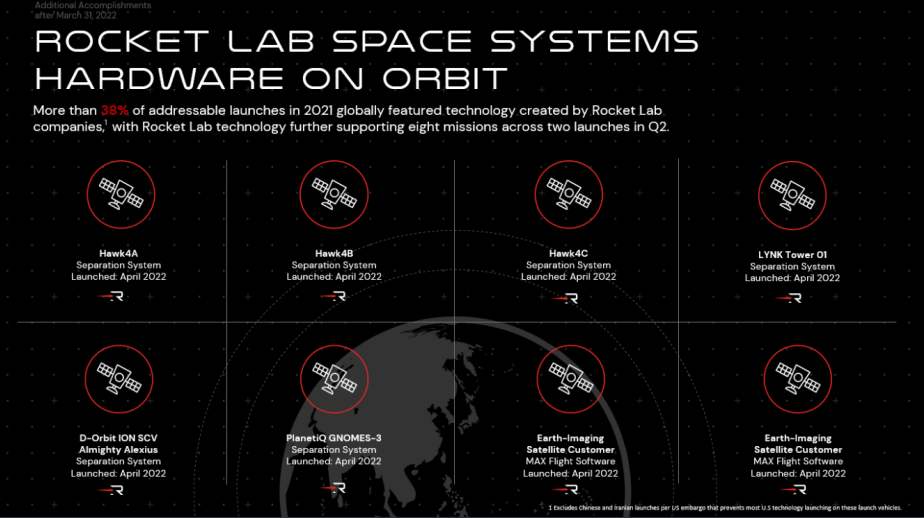

“We really know just about everybody in the industry from a spacecraft side. If we’re not launching them, we’re selling components into them,” CEO Peter Beck told Payload in April. In its investor deck yesterday, Rocket Lab emphasized that presence across the space value chain:

Case in point: Rocket Lab closed its acquisition of SolAero Technologies in Q1. It is qualifying the space solar cells, expects them to be ready later this year, and is producing solar panels for OneWeb’s broadband constellation.

Back to the bread and butter

While the company booked $6.6M in revenue from one launch in Q1, launch is “lumpy” on a quarter-to-quarter basis, Beck told analysts yesterday. And things are picking up: Electron is averaging a monthly launch cadence as of Feb. 28.

- The company booked less revenue on There and Back Again, an R&D mission featuring Rocket Lab’s Sikorsky S-92 completing a brief mid-air helicopter snag of an Electron falling back to Earth.

- The mission “proved reusability technology” and gave a roadmap for future aerial catches, Rocket Lab said.

Q2 guidance: $51M–$54M in revenue, with launch accounting for ~$19M and space systems kicking in the rest ($32M–$35M). Rocket Lab also guided to GAAP gross margins of 11%–13%. On the docket: a launch to lunar orbit with Electron, the Photon spacecraft bus, and NASA’s CAPSTONE payload.

+ Market data snapshot: $RKLB is down ~56% YTD. The company is valued at $2.5B.