Space markets surged this year, fueled by robust VC investments in private markets and back-in-vogue space SPACs in the public markets. The good year for space investments is part of a broader bull market, where the prospects of a soft landing have sent speculative stocks soaring.

Global Venture Capital Funding

Of the 15 largest space startup funding deals this year, five came from US startups, five were raised by Chinese companies, four were from European firms, and one was from an Australian business.

China: China’s funding has focused on launch and LEO satcom startups as it furiously builds out the infrastructure of its commercial space program.

Shanghai Spacecom Satellite Technology raised $943M for Thousand Sails, its Starlink-esque ~12,000 sat megaconstellation in LEO. The group launched three batches of 18 satellites this year.

Europe: MinoSpace, D-Orbit, and The Exploration Company secured the largest European raises of the year. The Exploration Company’s $160M funding is particularly noteworthy as it’s Europe’s most significant commercial effort to develop a crewed space capsule.

US Venture Capital Funding

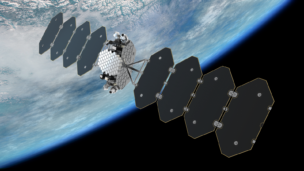

Space deals: US space funding was spread among various sectors in 2024. Micro geo-satellite manufacturer Astranis raised $200M; rocket startup Firefly nabbed $175M; orbital transfer vehicle maker Impulse raised $150M; and in-space manufacturer Varda secured $90M.

Outside the big names, the deal volumes were high—a healthy sign for the industry, although several companies likely had to raise at down rounds.

Spaceflight funding: The first large rocket funding round didn’t happen until Firefly’s November raise, underscoring the overall slow year for the sector. While 2023 saw Axiom, Firefly, Voyager, Sierra, and Stoke receiving big raises, 2024 saw more rocket startups announcing they were ‘exploring their options’ than closing rounds.

- Astra was taken private, wiping out nearly all its equity

- ABL Space pivoted to missile defense after a pad fire destroyed its latest rocket

- Relativity is reportedly struggling with liquidity and has been unable to find additional investment.

All three rocket startups were once valued at over $1B.

Sentiment: Investor enthusiasm for funding in space businesses has been high this year. However, some investors say that despite the heavy interest, finding a good business to invest in has been a struggle. Investors have sharpened their pencils, having a higher conviction of where opportunity lies…and where it doesn’t.

Public Markets

Here we go again. Space SPACs are raging again, with valuations surging by triple digits—and, in several cases, eliminating steep declines from the past few years.

Easing inflation, lower interest rates, and the prospects of deregulation and a refocus on space during the Trump administration have contributed to the surge. And while we’re here, a little sprinkling of market euphoria, short squeezes, and determined retail investors helped as well.

Intuitive Machines, AST SpaceMobile, Rocket Lab, and Redwire have led the way this year, with investors applauding development progress, large contracts, and rosier sub-sector outlooks. The four highest-performing companies saw their market caps balloon this year to:

- Rocket Lab: $12.2B

- AST SpaceMobile: $6.8B

- Intuitive Machines: $1.8B

- Redwire: $800M

The article was updated to include Apex’s $95M raise