STOKE Space Technologies announced this morning that it has raised a $65M Series A. The Seattle space startup is developing a fully reusable rocket.

- Breakthrough Energy Ventures led the round, which was joined by new investors Spark Capital, Point72 Ventures, Toyota Ventures, Alameda Research, and Global Founders Capital.

- Existing investors who also joined: NFX, MaC Ventures, Reddit founder Alexis Ohanian’s Seven Seven Six, and Joe Montana’s Liquid2.

- STOKE raised a $9.1M seed round last year. And the startup graduated from YC’s W21 batch.

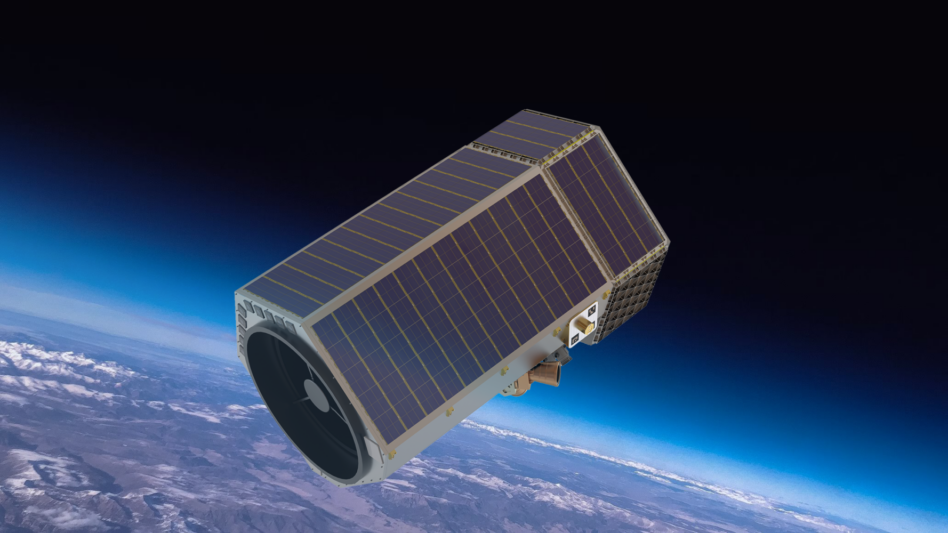

Second stage, first principles: STOKE aims to develop a fully reusable rocket. That starts with a rapidly reusable second stage, which represents “a problem that has yet to be solved by the industry,” cofounder and CEO Andy Lapsa told Payload. The new capital enables STOKE to fully develop a second-stage prototype—and hopefully, “fly this thing by the end of next year.”

Engineering a new thermal protection system from the get-go was in a way the company’s founding question, Lapsa said. He and cofounder Tom Feldman spent a combined ~16 years at Blue Origin before departing to start STOKE. On its current team, Lapsa said STOKE has “cherrypicked top talent from across the industry.”

On engineering: STOKE is designing a second-stage that does not use “brittle ceramic tiles.” That has the dual benefits of streamlining 1) inspection/refurbishment times and 2) aerodynamic surfaces that challenge hypersonic re-entry.

Given the 100+ rocket companies trying to reach orbit, one might think that it’s becoming an untouchable thesis for space-focused VCs. Lapsa didn’t disagree with this prognosis of the launch landscape.

Before starting STOKE, he asked: “Do we really need another launch company?” He and Feldman “systematically surveyed the market,” landed on their own “end state of what the market looks like,” and decided STOKE could solve launch problems that others currently aren’t tackling. More on that end state:

- Increased launch capacity and cadence are still required. Smallsat operators in “Western-allied markets” still have relatively few chances to hitch a ride to orbit.

- To reach tighter turnaround times, reusable rockets “can’t have detailed [days-long] inspections between flights, and certainly can’t have armies of technicians doing maintenance and refurbishments,” Lapsa said.

- “Reusability is the only way” to take customers where they want, when they want—without orbital layovers and with a cost structure that makes sense.

- The space economy must be developed sustainably and scalably (hence, STOKE’s emphasis on full reusability). “We can’t have hundreds or thousands of stages in orbit or the ocean,” Lapsa said. That may partially explain the round being led by Breakthrough Energy, a sustainability-focused fund founded by Bill Gates.