In a story that nearly writes itself, a Texas investor is swooping in to save a troubled rocket company just as it was teetering on the brink of bankruptcy.

Dallas-based VC Matthew Brown is set to invest $200M into Virgin Orbit ($VORB), a source told Payload. The news was first reported by Reuters on Wednesday.

- Brown has 15 years of space venture capital experience, investing over $1B of personal funds in companies like SpaceX, Rocket Lab ($RKLB), and Boom Supersonic.

The terms: Brown is funding the investment out of his family office, with no contributions from Energent, a fund where he also serves as GP. In exchange for the capital injection, Brown will receive a controlling stake in Virgin Orbit.

The $200M cash infusion couldn’t come at a better time. In January, after a string of four successful launches, Virgin Orbit’s Start Me Up mission experienced a mid-flight failure, resulting in the loss of nine customer payloads. With $VORB’s price in freefall and few funding opportunities, Virgin Orbit’s cash position worsened, eventually leading the company to halt operations and furlough staff last week.

The upside

A source familiar with Brown’s thinking said the investor sees robust business potential and competitive advantage in Virgin Orbit’s unique air-launch system.

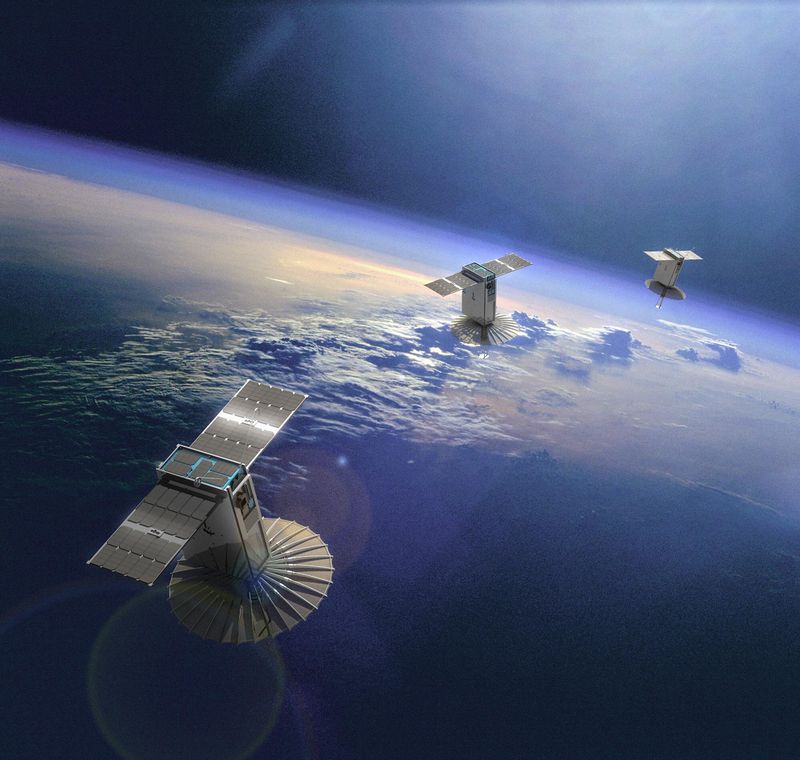

The capability could enable Virgin Orbit to launch small satellites or national security payloads within hours of notice (in theory). Traditional, vertical launch providers need significantly more lead time, due to pad and ground closure requirements.

- Virgin Orbit’s novel launch system involves a modified Boeing 747, nicknamed Cosmic Girl, carrying a LauncherOne rocket to a height of 35,000 ft.

- The rocket is then released, and its engines are ignited to propel it into orbit.

Brown is also acquiring a company with a proven track record of achieving orbit and a binding backlog of $143.1M (as of Sept. 2022). Moreover, Virgin Orbit’s total government contracts far exceed the $200M investment, which, according to the source, was a key factor in Brown’s decision to move forward with a deal.

Operational improvements

As for incoming operational changes, the source said the primary focus would be on keeping a tight lid on spend and ensuring that management is aligned on this goal. For context, Virgin Orbit burned $175M of cash in the first nine months of 2022 on $33M in revenue.

What’s next? The Goldman and Merrill Lynch brokered $200M deal is expected to close Thursday or Friday. While a date hasn’t been set, there is hope that the company-wide furlough could end as early as this week.