Colorado satcom company EchoStar’s ($SATS) stock price jumped over 80% after it announced the sale of some of its spectrum licenses to AT&T in an all-cash deal worth $23B.

The transaction is expected to close in the middle of next year. It will give AT&T ownership of 30 MHz of mid-band (3.45 GHz) spectrum, and about 20 MHz of low-band (600 MHz) spectrum—vastly increasing AT&T’s US network offering.

The plan: AT&T hopes the new deal with EchoStar will increase its ability to meet the growing demand for 5G connectivity. AT&T plans to begin using the mid-band licenses “as soon as possible” in a bid to capitalize on the growing demand for connectivity, especially in support of new technologies, like AI-native devices, autonomous vehicles, and advanced robotics.

To pay for these licenses, AT&T plans to use a mixture of debt and cash on hand—it ended Q2 with $10.5B in cash and cash equivalents.

The frequency battle: Competition to build the largest, most comprehensive US network is fierce, and the AT&T deal has other competitors, like T-Mobile and Starlink, hungry for their own piece of EchoStar’s pool of underused spectrum licenses.

EchoStar has been under fire from the FCC and SpaceX for underutilizing its spectrum licenses, and failing to meet deployment requirements in its bid to build a nationwide 5G network.

The deal essentially frees EchoStar up to take a different approach. Following the agreement, EchoStar’s Boost Mobile brand will be able to operate as a hybrid mobile network operator (MNO), providing connectivity to its customers through AT&T’s network.

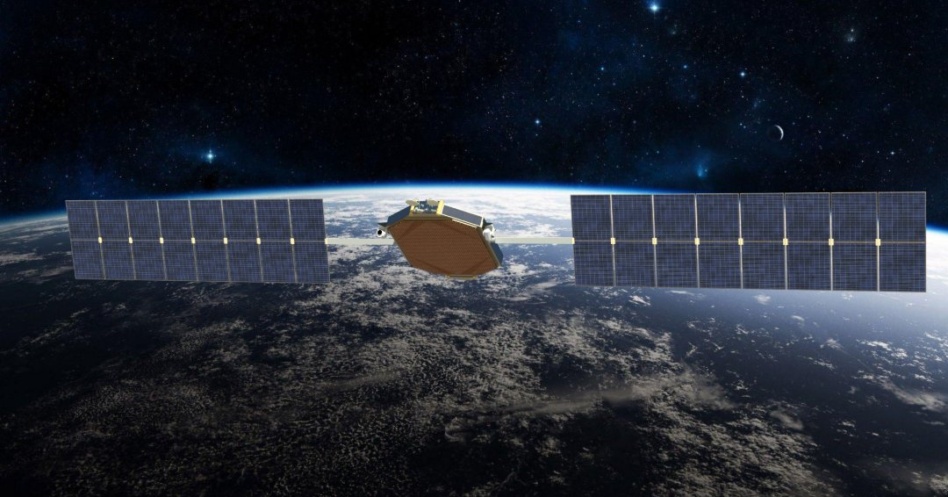

Much more than getting the FCC off its back, however, the deal gives EchoStar a huge cash boost to invest in its own direct-to-device (D2D) constellation. This month, the company ordered a $1.3B 100-bird constellation from MDA Space to pivot into D2D capabilities.

Direct talk: The fight for spectrum is only just getting started. In 2022 T-Mobile partnered with Starlink to begin exploring D2D capabilities, while Verizon and AT&T followed suit last year by announcing partnerships with AST SpaceMobile.

And it’s not a stretch to assume that SpaceX will continue trying to wrestle control of the EchoStar-controlled spectrum to beef up Starlink’s strained capacity.

In April, SpaceX used Starlink to run its own analysis of the 2 GHz band in an effort to show that EchoStar was failing to utilize its licensed capacity. Although it’s worth noting that EchoStar quickly fired back, calling SpaceX’s analysis “nonsensical.”