Albedo has announced a $48M Series A raise, in a round co-led by Bill Gates-founded Breakthrough Energy Ventures and Silicon Valley-based Shield Capital.

The Austin- and Denver-HQ’d satellite startup has now raised $58M, less than two years since its founding. Complementing Albedo’s big ol’ round is a padded out cap table.

The startup is a Y Combinator alum, graduating from the accelerator’s Winter 2021 (W21) batch. New backers announced today include Republic Capital, Giant Step Capital, and C16 Ventures. Existing investors Initialized Capital, Liquid 2, Kevin Mahaffey, and other unnamed investors also participated in the latest round. Fun fact: Liquid 2 is a seed-stage fund founded by NFL hall-of-famer Joe Montana.

About that cap table…

“Having Breakthrough and Shield co-lead our round is a great reflection of the breadth of applications our imagery will enable,” Albedo CEO Topher Haddad told Payload. “The company-building experience and industry knowledge that both teams bring will be invaluable in supporting Albedo’s growth.”

Haddad cited precision agriculture, forestry management, power line wildfire prevention, and defense & intelligence as core verticals that:

- need high-res optical and thermal imagery

- fit within both funds’ investment theses

The sweet spot

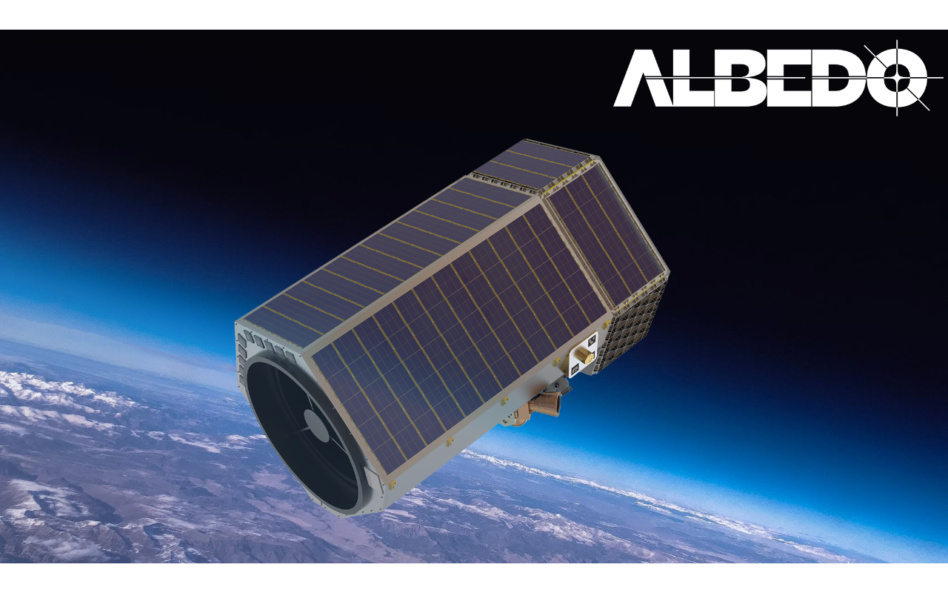

Albedo aims to collect high-fidelity 10 cm resolution optical imagery while co-collecting 2 m thermal infrared imagery from a small constellation of satellites.

- In need of a quick satellite imagery classification refresher? We got you…10 cm resolution means that one pixel in every image represents a 10 cm by 10 cm square on the ground.

- Industry comps: Maxar and Airbus currently sell 15 cm imagery, which they’re able to generate by algorithmically processing and upscaling resolution from 30 cm imagery.

How does Albedo plan to deliver the goods?

The company started with the simple question “what if you could fly satellites really, really low?” and is reverse-engineering its way to an answer. Albedo plans to fly its birds in VLEO—or very low-Earth orbit—at an altitude ~half the distance above Earth than the competition (450–650 km above Earth).

Albedo’s technical strategy has its drawbacks, such as atmospheric drag and shorter spacecraft lifespans. But the theoretical benefits of being closer to Earth could help the startup tackle industry pain points associated with resolution, latency, and pricing.

Did someone say pricing? Albedo is a card-carrying member of the transparent, upfront pricing club and already has its rates posted online: $35 per sq. km, with a minimum order size of 25 sq. km.

If all goes to plan, Albedo believes its six-satellite constellation will unlock high-res imagery for sectors that have yet to tap it at all. In fact, if Albedo can deliver, its offering may be cost-competitive with sub-Kármán line optical operations and eat market share away from camera-equipped Cessnas, enterprise DJI drones, and the like.

In sum…it’s time to build

Albedo has a warchest, a lean team of 21, and a speedy operational tempo. What’s more, its business strategy is relatively derisked on the regulatory front. Albedo secured a key, first-of-its-kind license in December to sell 10 cm imagery.

What’s left? Building, launching, and proving the first satellite. Albedo is fully funded through its first satellite launch, Haddad said, but still has a couple more years of hard work to prove its technology in orbit.

Payload meta takeaway

Broadly speaking, it’s been a quiet summer for capital deployment. But a handful of space startups have recently proven to be powerful exceptions to the rule. Beyond Albedo, just in the last two weeks, Atlas Space Operations raised a $26M Series B, Outpost raised a $7.1M seed, and Skyroot Aerospace raised a $51M B round.

+ While we’re here: We felt a bit of déjà vu writing this story. Another YC W21 space startup also semi-recently raised a rather large Series A led by Breakthrough Energy Ventures. Ringing any bells? If not, it’s STOKE Space Technologies, a Kent, WA-based startup developing 100% reusable rockets. You can check out our coverage of STOKE’s $65M Dec. ’21 round here.