Space unicorn Astranis recently announced that it had completed final tests for its first MicroGEO satellite. Payload recently caught up with Astranis CEO John Gedmark (via email) to discuss next steps, launch, satellite insurance, cellular backhaul, and everything in between. We last checked in with Gedmark in early December, when the $1.4B startup struck a $90M “landmark deal” with Andesat, a Latin American telco.

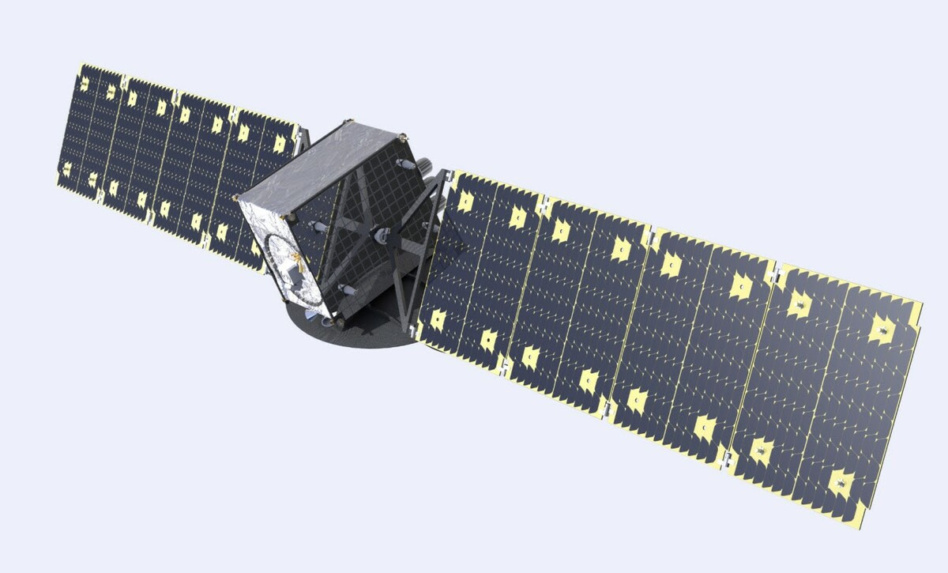

NB: This interview has been edited for clarity and length. Also, Arcturus = the startup’s internal codename for its first MicroGEO satellite.

Can you share any updated numbers on how much, precisely speaking, you anticipate this satellite closing the so-called digital divide (or bandwidth gap) in Alaska? Whether it’s users, devices, or coverage area…I’m just trying to grok the level of change you anticipate once you’re on-orbit and flip the switch, operationally speaking.

We’ll be providing reductions at the wholesale level, bringing the cost of satellite bandwidth to roughly ⅓ of existing costs. This will translate into a consumer service that is roughly ½ the cost of existing services.

But it isn’t really apples-to-apples. The existing services have spotty coverage, due to the placement of the megasat currently servicing the area being optimized for the lower 48. So even where there is coverage in rural areas, it isn’t the same speed or reliability as what we’re used to experiencing as true broadband internet.

Arcturus will change that by providing more than triple the currently available capacity over Alaska—and that’s with just one MicroGEO. With optimal placement for providing service to Alaskans, this dedicated satellite will provide true broadband speed and reliability to the entire state, from Anchorage to Nome to Utqiaġvik.

This is the first time in history that two things are happening: 1) Ubiquitous broadband coverage for the entire state of Alaska, and 2) Alaska will have its first dedicated communications satellite that was custom-built to serve Alaska.

What are the immediate next steps for the satellite?

Now, we’ll start prepping Arcturus for shipping to the Cape. Once it’s there, it will undergo some operational checks to make sure nothing got jostled during shipping. Soon after, it will launch into orbit. Not able to give much more detail here due to security.

Beyond launching sooner, are there additional benefits (beyond launching sooner) that came with your decision to move from Falcon 9 to Falcon Heavy?

The primary advantage of the Falcon Heavy is not an earlier launch, it is the time it saves on the other side. With the Heavy, we can direct-inject to GEO, saving the typical transfer time from GTO to GEO. But the overall goal was to do whatever we could to get Arcturus on orbit sooner, so that we can help the people of Alaska faster.

Is it an understatement to say you’re excited to see Falcon Heavy return to the launchpad?

Falcon Heavy is quite an achievement and I wouldn’t be the founder of a new space company if I didn’t feel inspired by what it represents. So yes, it is fair to say there’s some excitement.

How has your experience with launch procurement been to date? Theoretically speaking, how could having the ability to procure launches on Starship affect Astranis’s cost structure and bottom line?

Launch procurement is always an interesting process, all we can really say for now is that we are flying with SpaceX on this mission. On cost, this is more of a question for SpaceX. If they can deliver us to the same orbit for cheaper, we’re obviously interested.

I’d imagine it’s pretty hard to price in, account for, and underwrite all the risks of launching your first production-grade satellite. What does your all perils coverage say about the level of confidence–for you, your partners, and underwriters—that things will go smoothly this spring?

We’ve referred to it as groundbreaking for some of the exact reasons you mention. We went through extensive due diligence with the satellite industry’s top insurance underwriters. Because this is the first time a completely new satellite platform from a new space company has ever secured this level of coverage, it required us to build the insurance community’s confidence in us as a company, as well as in our satellite as a piece of hardware that they expected to work.

Willis Towers Watson, our insurance broker, was really helping in navigating the process. Launch plus one year of on-orbit protection—it’s an incredible endorsement of the quality of our satellites, and a vote of confidence in our technology as well as our business model.

Any update on the buildout of your ground stations in Alaska? Or is that PDI’s remit?

The ground station serving Alaska is actually in Utah, and will be operated by PDI. It is currently being built out and we can keep you updated on progress.