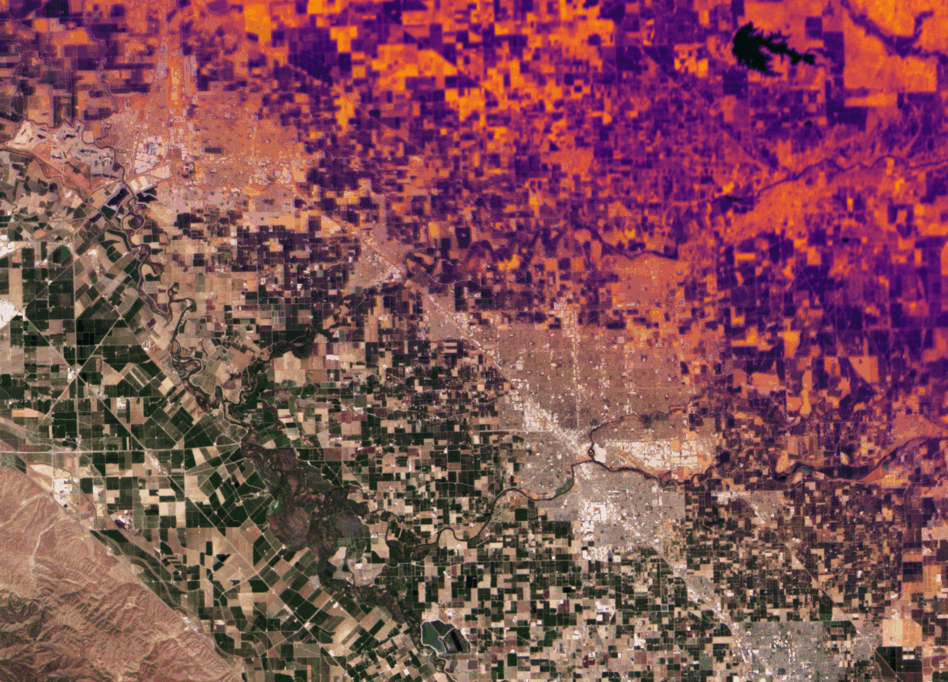

BlackSky Technology told investors last week that its 2025 revenue forecast fell by $12M to $20M due to “anticipated impacts of US government budget uncertainties, and volatility in contract timing.”

The $BSKY disclosure is another data point for investors watching to see how EO companies will fare under the new Trump administration.

Last month, six companies, including BlackSky, warned lawmakers that reduced spending on commercial space data “would sever critical data streams, stall key initiatives like Golden Dome and the Commercial Augmentation Space Reserve, and cede space industry leadership to China.”

Go global: Washington has offered mixed messages for EO firms, with rhetoric about commercial partnerships competing with budget cuts and supply-chain-complicating tariffs. BlackSky shares fell sharply after the revenue re-forecast; the stock price, however, is up more than 80% during the last six months.

Will Marshall, CEO of competitor Planet Labs, has said there is plenty of opportunity in DC—but his company has been recording wins abroad, particularly in Germany and Japan, as US allies look for reliable space intel.

While BlackSky earned more abroad than in the US in the first quarter of 2025, its global business is focused in the Asia-Pacific region and the Middle East, according to SEC filings.

Buy and build: BlackSky also announced plans to raise $160M in convertible debt, in a transaction that closes today. Most of that money will effectively refinance the company’s existing credit lines, but there will be $40M left over that could fund new tech development.