Kelly Ortberg’s first earnings call as Boeing CEO on Wednesday reported a $6B loss in the third quarter as the company faces a strike on top of production problems.

From a Payload point of view, Ortberg’s outlook on the space business was shared mostly by omission as he made clear that “Boeing is an airplane company.”

“We’re better off doing less and doing it better, than doing more and not doing it well,” Ortberg said. “Clearly, our core of commercial airplanes and defense systems are going to stay with the Boeing company for the long run, but there’s probably some things on the fringe there that we can be more efficient with, or that just distract us from our main goal here.”

Fringe festival: Boeing earned $6.7B from its defense and space business in 2023, with much of that coming from military aircraft production, compared to $10.5B from its commercial airplane work. That disparity might put space on the outs, especially considering recent challenges:

- Starliner’s first operational flight is now delayed until at least August.

- A geostationary satellite it built for Intelsat broke up in orbit last week just eight years into its mission.

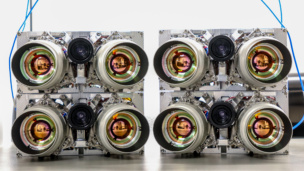

- Jason Kim left his position as the head of Millennium, Boeing’s small satellite division, to become CEO of Firefly Aerospace.

- Even former NYC Mayor Mike Bloomberg is calling for NASA to cancel the Boeing-led SLS rocket program.

- The Boeing-built ISS is set to deorbit by the end of the decade.

- ULA, its rocket-building joint venture with Lockheed Martin, is reportedly up for sale.

Is space defense? Given those facts and Ortberg’s five- to ten- year planning window, it’s easy to imagine space going by the wayside without the company having to do much at all. A saving grace may be if executives decide that national security space spending—like the $386M contract to Millenium for six missile tracking satellites announced yesterday—is too lucrative to give up.

Customers beware: Analysts asked Ortberg about the charges the company has been taking on fixed-price contracts, such as Starliner or the K-46 tanker.

“The discipline about what we can control on those contracts needs to get better,” Ortberg said. “I don’t think we’ve been doing enough work with our customers to figure out how to derisk these things before it turns into a [cost estimate] overrun.”

That likely means higher bids or more generous contracts for future big-ticket development programs.