(Editor’s note: This is Payload Research analysis. You can sign up for our Research newsletter here.)

EchoStar reported another quarter of declining revenue last week as its Hughes Network satellite broadband, TV (Dish + Sling), and retail wireless (Boost Mobile) subscriber base continues to shrink.

Declining TV subs are driven by the advancing streaming and cord-cutting landscape while Hughes Network’s internet subs face strong competitive pressure from SpaceX’s Starlink network.

+ Billions to pay back: The company also faces a $2B debt maturity payment that is coming due in less than six months, which has prompted the company to warn that “substantial doubt exists about our ability to continue as a going concern.” However, the company said it was actively discussing raising capital with investors.

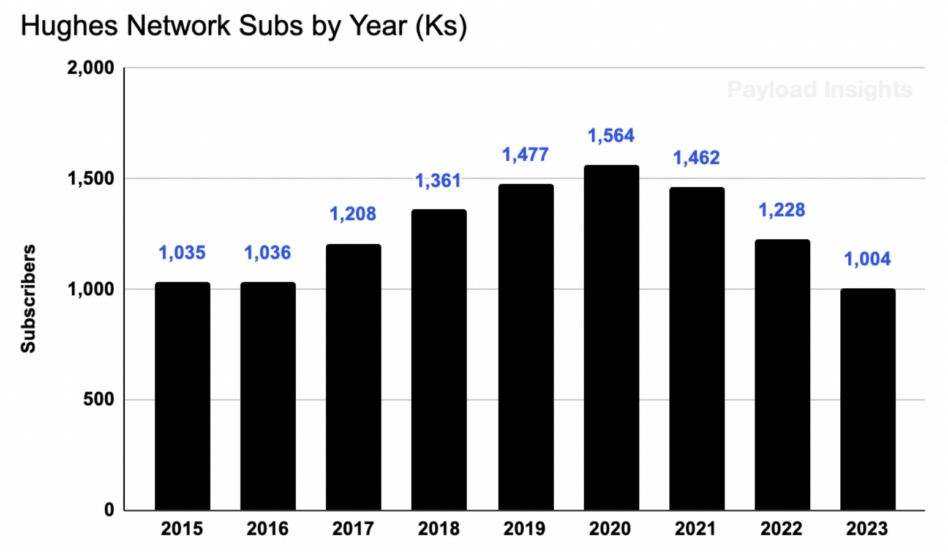

Hughes Network Duels Starlink

HughesNet is EchoStar’s satellite internet service, which is provided via its school-bus-sized GEO birds. The subscriber base had been experiencing strong growth—peaking at 1.6M subs in 2020—before a sudden halt and sharp decline.

- What happened during the 2020-2021 timeframe? SpaceX began ramping up Starlink constellation deployment and opened its subscription pre-orders to the public.

- Since SpaceX launched the Starlink internet service, its customer base has surged—while the HughesNet subscriber base has declined.

The rapid HughesNet subs decline is particularly notable given that customers are typically locked into 24-month contracts, which should blunt dramatic downswings.

(Note: SpaceX provides Starlink ‘customer’ numbers, which are not the same as subscribers—so the following two charts are not entirely apples to apples.)

Cue correlation/causation caveats. While we can not solely attribute HughesNet’s decline to Starlink, it is the largest driver here.

“We are obviously losing some subscribers to other technologies and other LEO networks”, said HughesNet’s former CEO, Pradman Kaul, on the company’s Q2 2022 earnings call. “The biggest threat right now really is Starlink because they are—they can address the latency issue that the GEO sat has done. So we’re losing some subs clearly to Starlink.”

Mix shift for the win: On a positive note, HughesNet suffered a net subscriber loss of just 26,000 in Q1, the lowest decline in 10 quarters. The mini-stabilization can be attributed to a higher proportion of enterprise customers, which tend to be stickier.

- The company said 50% of revenue will be derived from enterprise customers this year, up from 35% just two years ago.

- The Starlink service is primarily a consumer business—for now—with only 3% enterprise customers.

Dish + Sling TV Duel Streaming

Subscriber demand trends for the company’s TV segment are not much better than for satellite internet.

At the end of last year, EchoStar completed its acquisition of Dish, which included Dish TV, Sling TV, and Boost Mobile products. Dish and Sling have seen a steady decline in users due to rapidly advancing streaming adoption and changing TV consumption dynamics. YouTube TV’s streaming service recently hit 8M subscribers, making it the fourth largest TV provider, overtaking EchoStar’s Dish TV for the spot.

“We continue to experience competitive pressure from programmers who ship content from traditional pay TV to their own direct-to-consumer services,” said Dish EVP Gary Schanman on last week’s earnings call.

While the subscriber base is diminishing, the service still generates substantial revenue, with Pay TV accounting for $11.6B in sales for 2023.

Retail Wireless Division

EchoStar’s retail wireless division primarily consists of Boost Mobile, which the company acquired in the Dish Network acquisition earlier this year. The company reported net positive Boost Mobile subscriber growth in March.

Path Forward

The company reported $766M of cash/marketable securities on hand at the end of Q1—after paying down $1B of debt on March 15. With limited cash and forecasted negative cash flow, there is concern over whether the company can find the capital to repay the loan. The predicament prompted equity analyst Craig Moffett to forecast that bankruptcy was the most likely outcome in four to six months.