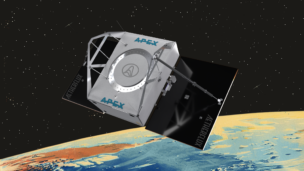

Picture this: Albedo Space, the Colorado startup operating the Clarity-1 imaging satellite in VLEO, is getting out of the commercial imagery game.

Albedo CEO Topher Haddad told Payload the company will abandon its imaging business to focus entirely on building VLEO satellite buses for other payload operators—a decision which includes laying off an undisclosed number of employees.

The shift comes in response to the better-than-expected success of Clarity-1, as well as market signals that VLEO demand will continue to increase for defense and commercial missions.

“While it might look like a pivot from the outside, we’ve actually been building toward this for some time,” Haddad told Payload. “We’ve tested the commercial imagery market and the VLEO systems market, and we’re doubling down where we see the strongest mission need and customer demand.”

Seeing with Clarity: In March, Albedo launched Clarity-1—its first commercial imaging satellite in VLEO. In the months since, Albedo quickly discovered that the value of its hardware was greater than the images it was able to collect flying its own constellation.

The main struggle of flying in VLEO is working against the heavier atmospheric drag that is present when flying closer to the Earth’s surface. Albedo expected its satellites to have a total lifespan averaging five years, but quickly discovered that Clarity-1 was performing 12% better than expected, according to Haddad.

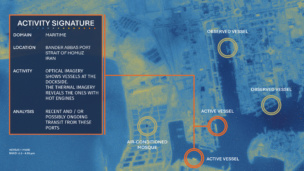

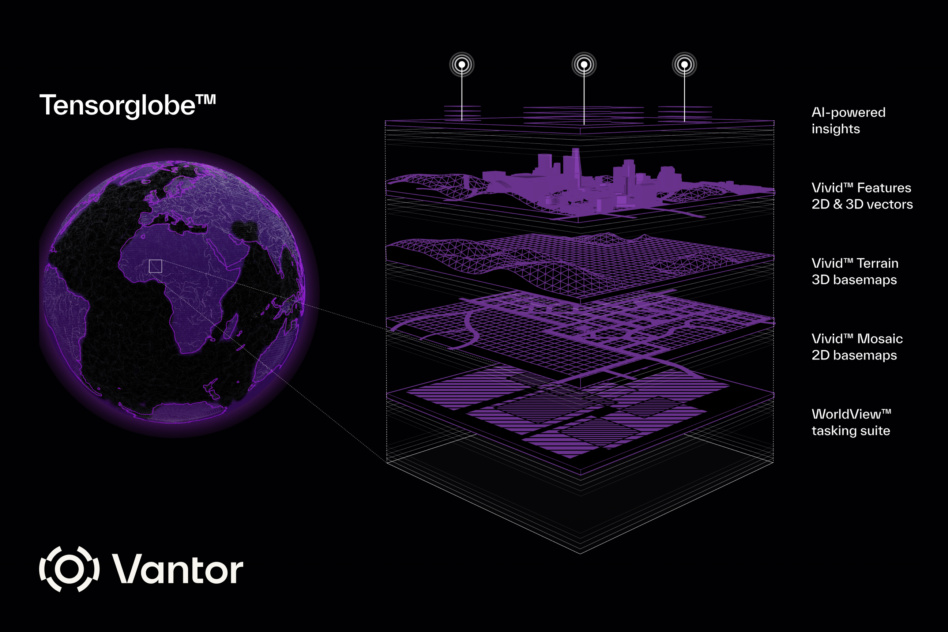

This improvement made it clear that Albedo could create more value by offering other payload operators—in imagery, communications, or defense—a platform to fly their own payloads in VLEO.

“VLEO has always been something that if you could fly there for a long time, of course you would, but nobody has proven that out. So, we’re narrowing our focus, given the opportunity,” Haddad said.

As a result, the company laid off some employees working on the commercial imagery side of the business to double down on its decision to develop and produce VLEO capable satellite platforms. Haddad declined to share how many of the company’s employees have been let go, but said that majority of the engineering team would remain in place.

Opportunity abounds: Albedo’s shifting priority is more than just a response to killer tech, however. It’s also a direct reflection of the market’s increased focus on defense, and fielding constellations that span multiple orbits.

Going forward, Albedo will continue to expand its capabilities in VLEO, flying Clarity-1 and future satellites at lower and lower altitudes to increase the benefits of the near-Earth orbit, as well as expanding its product line to support a wider range of payloads.

The company plans to ramp up its production capacity to produce hundreds of satellites per year, as fielding a global constellation in VLEO requires 20% to 30% more satellites compared with LEO, according to Haddad.

“[For] every critical mission that flies in LEO today, adding a VLEO layer really improves the diversification and redundancy and resiliency for the overall system,” Haddad said. “We are the only company with a VLEO bus on the market that also is flight-proven, and ready today.”