SynMax, a satellite data analytics startup specializing in oil, gas and dark ship monitoring, has raised a $6M seed round from a group of existing customers. Bill Perkins, an energy trader and cofounder of SkyFi, and GeoSol Capital LLC participated in the round.

What’s the name of the game for SynMax?

The Houston startup is dedicated to generating unique data analytics in high-value niches.

Rather than bringing any data collection capabilities in-house, SynMax is focused exclusively on generating customer-ready analytics. “The sweetest part of the value chain is the one that controls the end customer,” SynMax CTO Eric Anderson told Payload.

Anderson said that the funding round, which was entirely raised from current customers, speaks to the value of providing analysis of these niches.

“There’s been tons and tons of money during this last tech boom that went into launching satellites,” Anderson said. “There’s lots of satellite companies now, and my opinion is that those companies are not going to be successful unless companies like SynMax come in to do the last-mile delivery, which is transforming satellite images into SaaS products that businesses want.”

Hyperion

The product that started it all uses satellite imagery to predict changes in oil and gas production. SynMax says that Hyperion can make these predictions faster than any other data sources at energy traders’ disposal. Anderson, a former energy trader himself, says he was frustrated with the lack of timely and accurate oil supply data.

“Energy trading is extremely fundamental,” Anderson said. “Unlike any other asset that gets traded, it is completely based on supply and demand…and the information that is available is extremely opaque.”

- Government data on the movement of frac crews, for example, has a four-month delay before it reaches traders, making it tough to accurately predict supply.

- Frac crew = the team needed to run a fracking operation.

SynMax’s analytics stack scans Planet optical and SAR imagery for frac crews and oil rigs. Frac crews tend to move around every week or so depending on the well operators’ needs, Anderson said, while rigs stay in place for several weeks at a time. Tracking the movement of these assets provides the backdrop for a much faster, more accurate oil supply estimate.

Theia

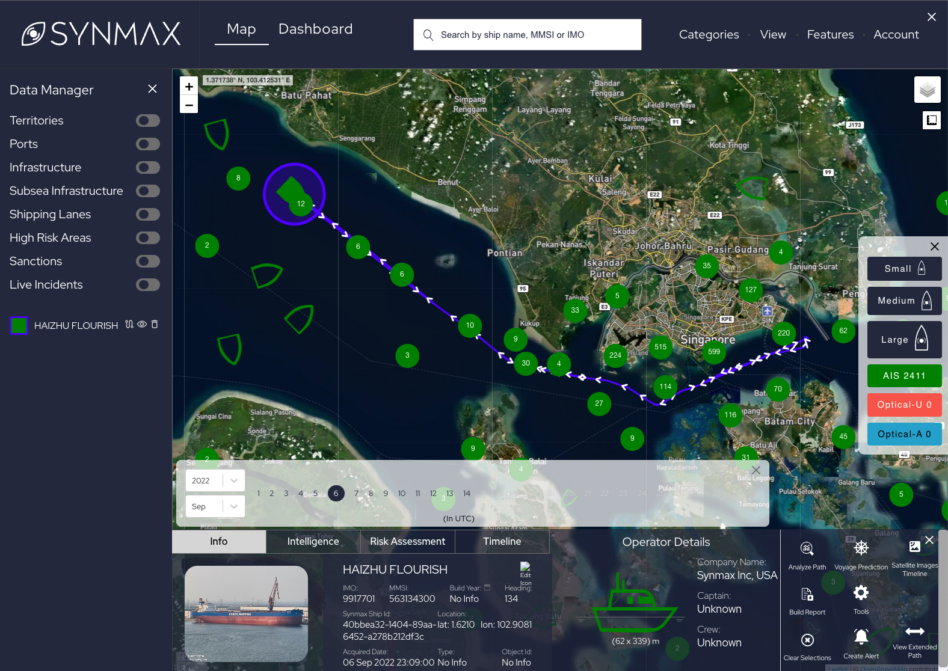

The company is currently building out Theia, its second product, which uses the same satellite data with a different detection algorithm for a new target: dark vessels. These vessels are ships that turn off their automatic identification system (AIS)—a voluntary, unencrypted radio signal—to evade detection.

Ships may turn off their radios for benign reasons, like taking an unapproved route to save a bit of fuel, but many dark vessels shun AIS and seek secrecy to obscure trafficking, illegal fishing, or piracy, among other illicit activities.

“All of our goods, at one point in their life, were on a ship,” Anderson said. “The entire value of the Earth moves on the ocean, and it’s two thirds of the Earth’s surface, and it’s extremely poorly monitored.”

Governments are particularly interested in dark vessel tracking data, as are companies with value at risk on the high seas.

What’s next? With the closing of its seed round, SynMax is looking to make a slew of new hires to A) speed up Theia development and B) get to work on new product ideas. In keeping with its first focus—energy trading—the startup’s next product idea is for a coal pile monitoring platform that can give users advance indications of energy stockpile levels.

“I think it is under-appreciated, the value of data in energy transition,” Anderson said. “Everybody loves talking about how we’re going to build more renewables, more charging stations and more infrastructure, etc. But…the transition period is extremely delicate and needs to be done properly. And the way to do it properly is to give stakeholders better information.”