On Thursday, shares of newly public Intuitive Machines ($LUNR) closed at $44.77 a pop, up a staggering 251% on the day. The company’s stock has tripled in three days of trading.

Trading of the lunar exploration company’s stock was briefly halted midday as volatility triggered the NASDAQ circuit breaker. The surge comes just three days after Intuitive Machines completed its reverse merger with Inflection Point Acquisition Corp ($IPAX), a special-purpose acquisition company (SPAC). The Houston company announced the deal in September.

Redeem team

Intuitive Machines originally anticipated that its SPAC transaction could generate $301M. However, a recent filing with the SEC revealed that SPAC shareholders opted to redeem a whopping $279.9M (or 27.5M shares) prior to the transaction, which closed on Valentine’s Day. The high redemption rate leaves Intuitive Machines with far less cash than expected.

$LUNR 101

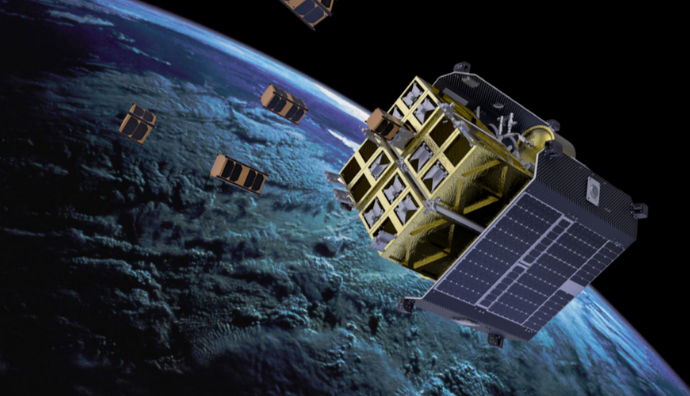

Intuitive Machines specializes in building products and technologies serving the lunar economy. Capital raised from the IPO will be used to fund lunar lander missions, along with various Moon-focused R&D projects. Head here for more on the lunar firm’s product offerings.

Is the SPAC back?

Intuitive Machines’s high redemption rate—and bonkers trading patterns over the last three days—come at a time in which SPACs have crashed back down to Earth. Rising interest rates, and a general shift from vibe-based to fundamentals-based investing, have led to a sharp decline in new SPAC listings, from a record high of 613 in 2021 to just 86 in 2022.

However, this week investors shrugged off any SPAC weariness and sent the stock soaring.