Shares of Japanese startup ispace closed at 1201 yen a pop on Thursday, up 373% on the day. The surge comes just one day after ispace made its Tokyo Stock Exchange Growth Market debut.

Ispace IPO: Shares were listed at 254 yen each during the IPO, originally valuing the company at 20B yen ($150M), according to Nikkei. So far, demand has far outweighed willing sellers resulting in shares going untraded on Wednesday and soaring on Thursday,

Investing in space: Investors are optimistic that the anticipated investment in the cislunar economy, particularly from the Japanese government, will result in significant demand for ispace’s robotics products.

- ispace’s IPO bonanza comes at a time when many publicly-traded space businesses have struggled to gain footing under the scrutiny of public investors.

- Notably, Virgin Orbit was forced to file for bankruptcy last week, while Astra, Spire, and Momentus all recently received stern Nasdaq delisting warnings.

A lunar landing date

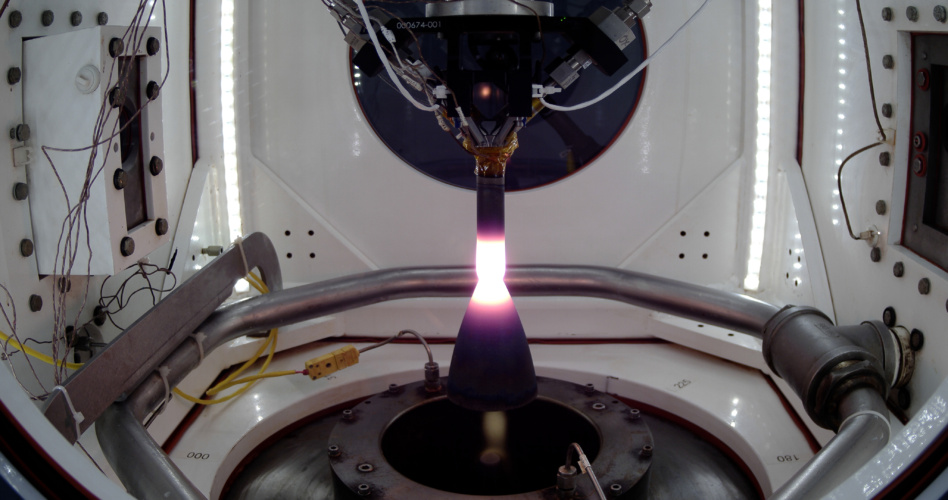

On the day ispace made its stock market debut, the startup also announced it would attempt its HAKUTO-R lunar landing on April 25. The lander is currently in orbit 100 km above the moon.

“The stage is set. I am looking forward to witnessing this historic day, marking the beginning of a new era of commercial lunar missions,” said ispace chief Takeshi Hakamada.

The journey thus far: In Dec 2022, the HAKUTO-R lander was launched aboard a Falcon 9 rocket. The spacecraft arrived at lunar orbit on March 20 after taking the lengthier three-month route to conserve fuel.

- If the HAKUTO-R can nail a soft touchdown, ispace would become the first privately-funded enterprise to land on the Moon.

Everyone’s an influencer ispace will live-stream the historic landing, giving us a chance to nerd out in real time.