Mynaric, the German laser communications startup, completed its financial restructuring this week—reigniting the possibility of an acquisition by Rocket Lab, but leaving investors holding the bag.

What went wrong: Ultimately, the issue came down to unlucky timing, Joachim Horwath, Mynaric’s cofounder and CTO, told Payload.

Mynaric had invested heavily in building out its production facilities, in parallel to the development of its optical comms tech.

The company then experienced supply-chain issues that left it holding millions of euros in partially completed inventory. When coupled with slower than expected customer uptake, the company was stretched too thin to keep the lights on without a lifeline.

In total, PIMCO-affiliated lenders floated $169.5M (€145.9M) to Mynaric, including:

- An initial loan of $95M (€81.8M) in April 2023;

- $49.5M (€42.6M) in bridge loans between October 2024 and February 2025;

- Finally, a $25M (€21.5M) loan in February 2025 to restructure the company and assume complete ownership.

“PIMCO always said, ‘I’m happy to help you guys. I know your customers. I know this technology is the future. I’m happy to put in more money, but at the end of the day, I want to have the keys’,” Horwath said. “That led to this restructuring, where the shareholders came out empty.”

Far from being deterred, however, Horwath sees the situation as better than the alternative. Mynaric was never forced to lay off employees, and it can continue developing its tech without risking being sold for parts.

“[It’s] not a bankruptcy. We were actually quite taken care of by PIMCO, but, of course, the ownership changed,” Horwath said. “We have other companies in Germany that are not so lucky.”

Still standing: Rocket Lab, which announced its intention to acquire Mynaric in March, said it would wait until the restructuring was complete to continue negotiations with the new owners, JVF-Holding.

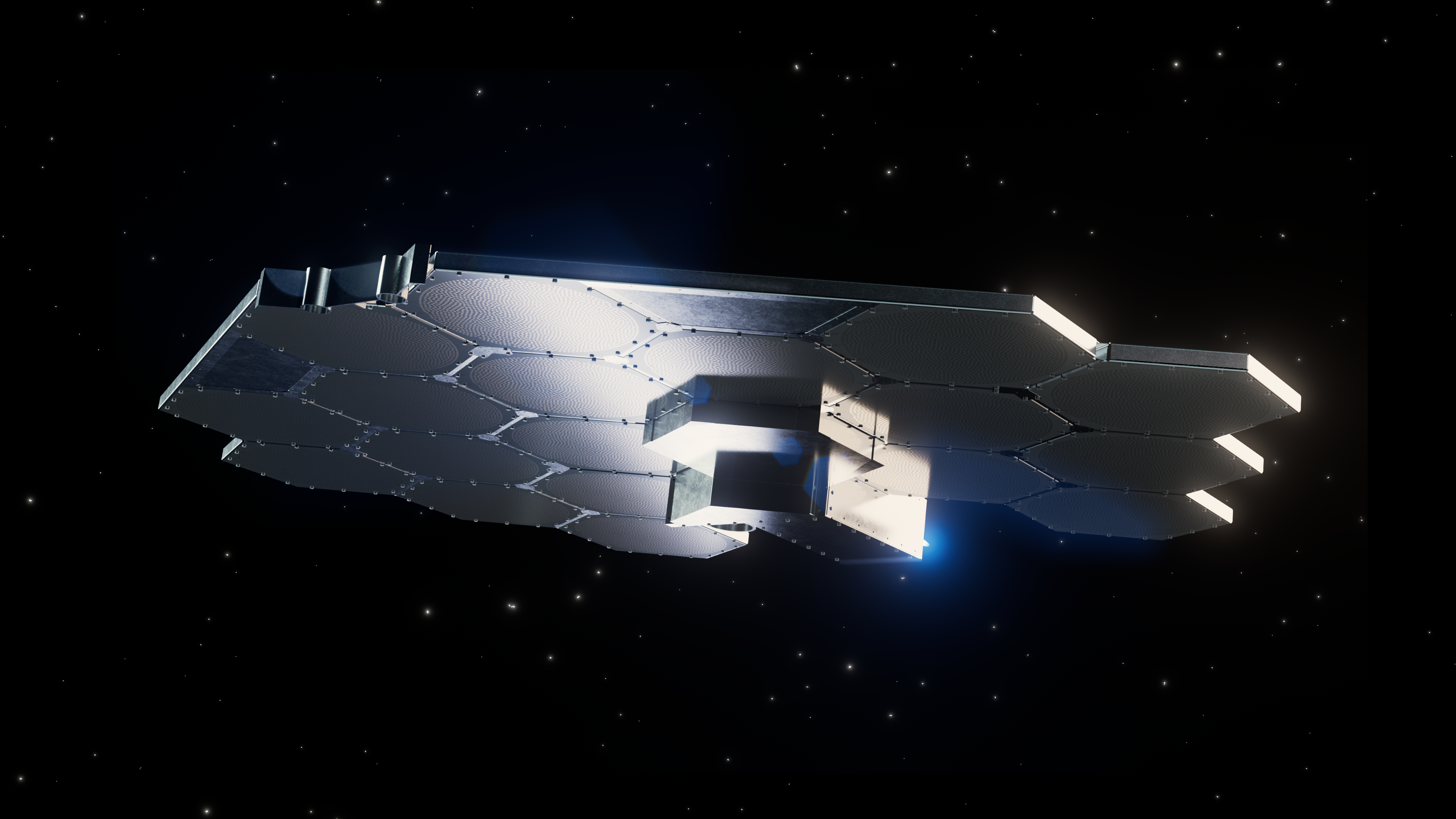

Mynaric had provided its CONDOR Mk3 optical comms terminals as a subcontractor to support Rocket Lab’s development of 18 sats, under a $515M (€443.4M) contract with the US Space Development Agency. But the decision to fold Mynaric under the Rocket Lab umbrella was driven by more than just vertical integration.

- As Rocket Lab’s first acquisition of a European company, the deal could kick open the door for more contracts and closer relationships on the continent at a time when interest in laser comms is growing—and European nations are investing more heavily in building sovereign capabilities.

- Rocket Lab also mentioned in its acquisition announcement that laser-comms tech has become a pain point for constellation operators. Rocket Lab intends to scale up production to make intersatellite laser comms affordable and reliable.

- It also doesn’t hurt that Rocket Lab expects to purchase the company for $75M (€64.6M)—a fraction of the $300M+ (€258M+)invested in Mynaric to date.