SatixFy is bucking the trend and staying the course.

SatixFy 101

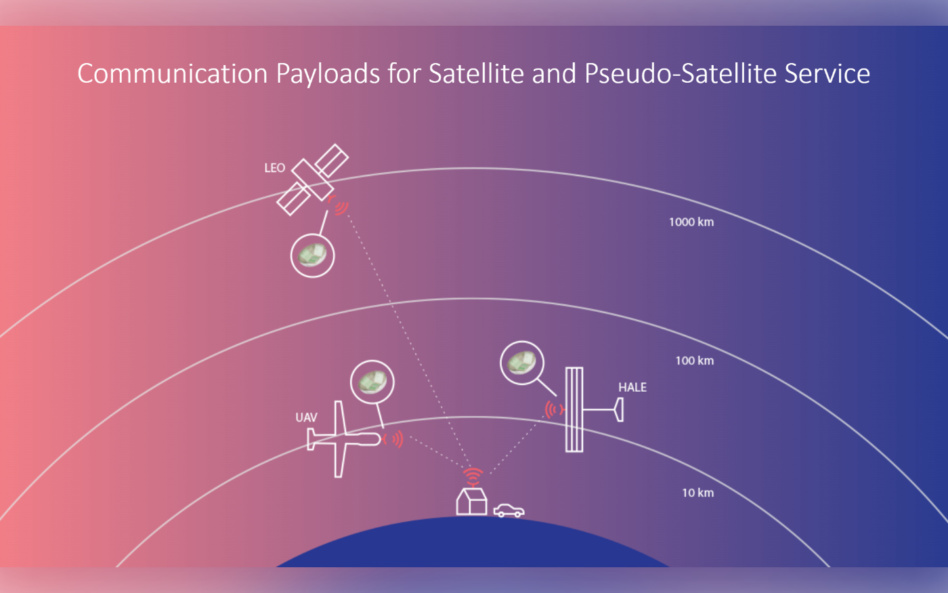

- The Israeli startup is a fabless chipmaker and developer of electronically steered antennas.

- Its portfolio consists of “end-to-end” products, ranging from satellite payloads to end-user terminals.

- SatixFy recently unveiled Onyx Aero, a terminal for commercial airliners and large corporate jets that can connect to satellites in LEO, MEO, and GEO orbits.

Bucking the trend…

This year, two space startups have walked away from SPAC mergers.

- Tomorrow.io, a weather forecaster and constellation developer, called off its merger with Pine Technology Acquisition Corp ($PTOC).

- Earlier this month, Italy’s D-Orbit and Breeze Holdings Acquisition Corp. ($BREZ) nixed their merger agreement. The last-mile space transporter announced plans in January to go public at a post-deal valuation of ~$1.3B.

Staying the course…

SatixFy expects to finalize its merger with Endurance Acquisition Corp ($EDNC) on Nov. 7, but there’s a catch. SatixFy’s equity value was slashed 27%, from $500M to $365M, per a Wednesday SEC filing.

Deciphering the decision

The frothy markets of 2021 are no more and the Payload Space SPAC Index is down 36.6% this year (as of Thursday). Like so many of its peers, SatixFy faces a difficult macro environment and supply chain headwinds.

While Tomorrow.io and D-Orbit have more confidence in tapping the private markets for capital, SatixFy still appears to have faith in the public route.

- The company tried unsuccessfully to conduct a public offering on the Tel Aviv Stock Exchange. And, Globes reports, SatixFy cut its 2022 revenue forecast by 75%.

- The new terms may be a tradeoff, featuring more dilution but better prospects for a public debut and company shares.

Correction: An earlier version of this story misstated the equity value of SatixFy. The error has been corrected.