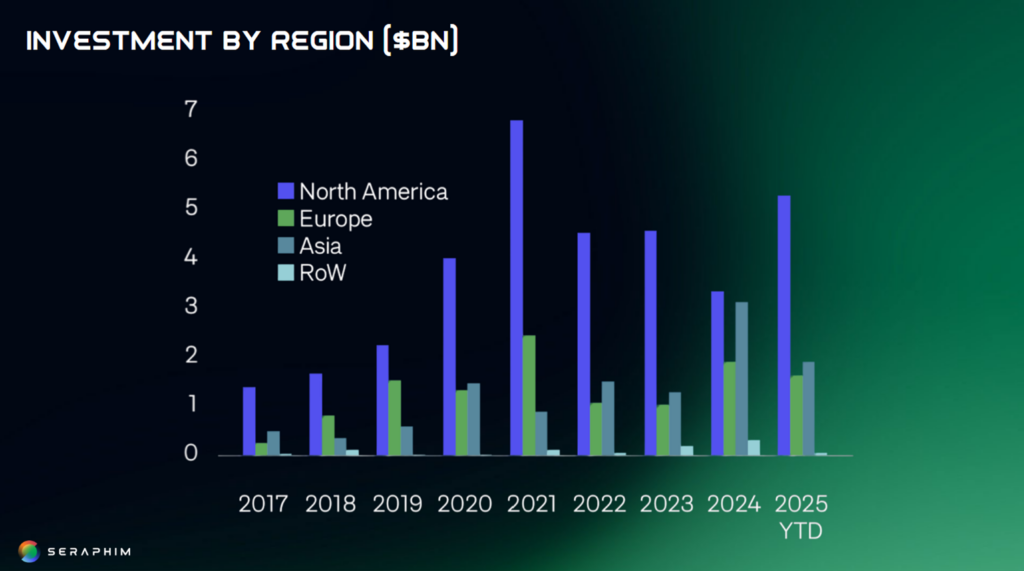

The inaugural Space Investment Conference kicked off in London this week, bringing together founders and investors to discuss the financial future of the space industry—which now has more money than ever.

“This market is growing very rapidly, with a thriving ecosystem of thousands of companies around the world,” Mark Boggett, CEO of Seraphim Space, said at the conference. “With defense budgets of €1T in Europe…we’re seeing a lot of new investors. $39B (€33.2B) has entered this market in the last five years, which we forecast to accelerate given the global tailwinds of defense—which are now speeding into a hurricane.”

Put to work: Compatibility with European public investment in space was a mainstay of the conference. Investors discussed how to align their portfolios with decisions made by entities like the European Investment Bank and the European Fund for Strategic Investments.

The goal, as some investors saw it, is to sell bold, long-term visions of the future that could be created through space infrastructure, while highlighting real returns in the short term, chiefly in Europe.

Sanjeev Gordhan, general partner at Type One Ventures, told attendees to imagine the technological conveniences available in the world in 100 years, conjuring suggestions of intravenous nutrition or the robotization of labor, as well as wry aspersions about dystopia and apocalypse.

“In the UK and Europe, conversations like this can be understood as fluffy. But in the US, this is how people build a narrative,” Gordhan said. “Narratives like these helped us bring AstraZeneca into drug production in orbit.”

Gordhan also reported Type One seeing pre-seed Series A rounds with space businesses, with exits at 8x investment.

Gold rush: Returns like these are opening opportunities for investors who have not traditionally worked in the space market. Mark Hankinson, co-head of equity capital markets at Deutsche Numis, mentioned that Deutsche Bank is one of the few banks with a dedicated space research analyst—a fact he was confident wouldn’t remain true for long.

“We need to recognise there is a gulf of knowledge between the VC community and public markets,” Hankinson said. “There’s also a gulf in the space sector itself about how investors think about the world. Scale is absolutely crucial—decision makers aren’t capital-constrained. They are time-constrained. They need the right size of project.”

Military social good: Some conference speakers called for a redefinition of ESG guiding much of Europe’s public spending. Two separate presentations engaged with the principle of folding dual-use space technologies into ESG. David Balson, strategic director of Lumi, also proposed the ESG-R moniker—standing for environment, social, governance, and resilience.