AST SpaceMobile ($ASTS) stock plunged nearly 30% this week after the cash-strapped company announced Tuesday it had raised $59.4M in a steep discount public offering.

The satellite manufacturer sold 12.5M shares at ~$4.75 a pop, well below the ~$6.50 price tag the shares were trading at before the offering.

Space → Mobile: The Odessa, TX-based company aims to beam down space-based 5G connectivity directly to unmodified smartphones via a planned 168-bird constellation, serving as “cell phone towers in space.” The service differs from other satellite connectivity providers, such as Starlink, which send signals down to designated ground terminals, not regular mobile devices.

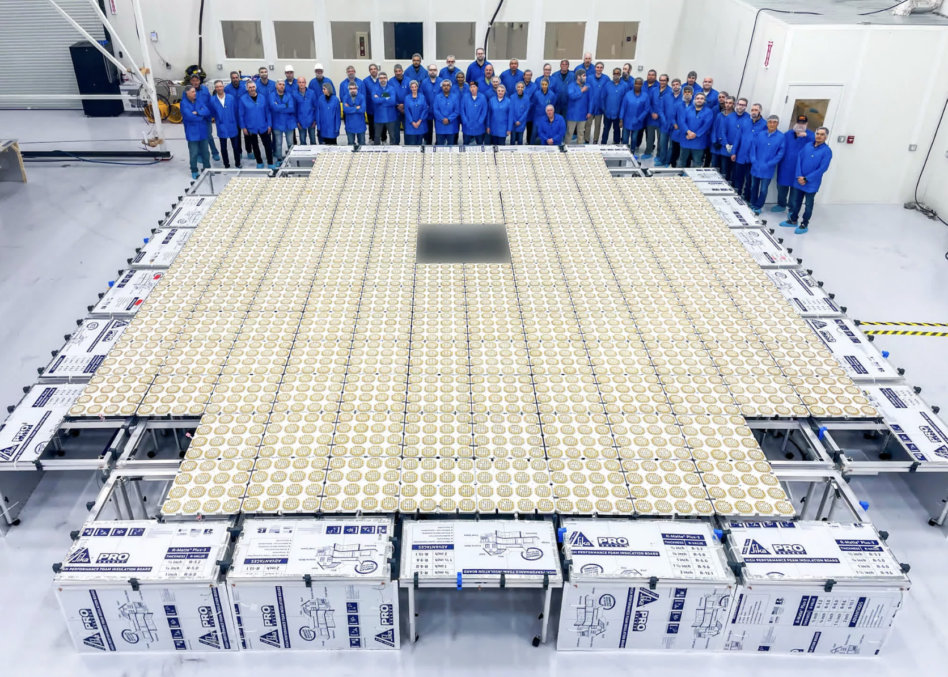

- AST deployed its BlueWalker 3 test satellite in September and a couple of months later deployed its monster 693-sq-ft comms antenna—the largest of its kind in LEO.

- Last week, the company successfully provided 4G connectivity to an off-the-shelf cellphone.

A cash lifeline: The satellite manufacturer is burning cash at approximately $60M a quarter, inclusive of capex. Post-capital raise, AST will have ~$200M of cash in its coffers. While the public offering provided the company with some more breathing room, AST is still sitting at less than a year’s worth of cash burn.

With a 168-satellite constellation planned, the company will likely need to continue seeking additional funding options.

Public whiplash: Earlier this month, a company executive was quoted giving an upbeat assessment of its strategic funding options. Given the discounted and dilutive public offering, AST had to formally walk back the comments in an SEC filing this week.