Investment in the space economy is bouncing back from the sagging markets of last year, led by a couple of mega deals centered around investors’ growing appetite for commercial space stations.

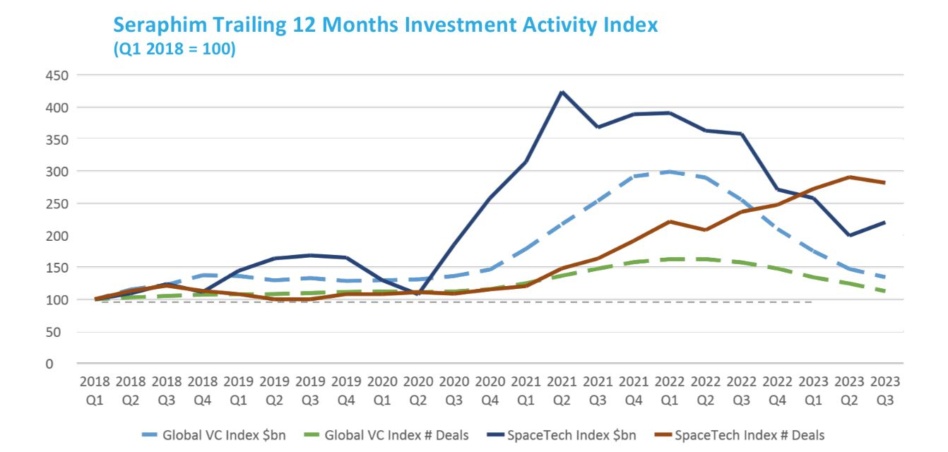

Seraphim Space (aka Generation Space in the US), a leading space investment firm, published its quarterly report on investment activity in the global space economy. According to that report, Q3 2023 saw $1.6B in new investment, up 39% from the quarter before. Over the last 12 months, investment across the industry is up to $5.6B.

The economic landscape: Global markets hit a dramatic low in 2022, and investment activity over the latter half of last year dragged. Now, though, we’re seeing an uptick in both number of deals and average deal size, signaling an increase in investor confidence in the space economy and its growth prospects for the years ahead.

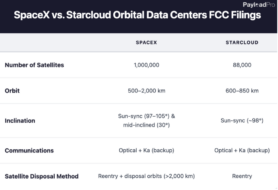

Big ticket items: In Q3, Seraphim tracked 82 deals in the new space economy, just about on par with Q2 at 85. The size of those deals, though, far surpassed last quarter on average, led by a handful of monster rounds of funding. Those leaders:

Turns out building a space station is pretty expensive. Investors are seeing the vision, though.

“Unsurprisingly, the high CapEx requirements to develop next generation space stations and earth return vehicles require large investment rounds,” the analysts wrote. “Investors are demonstrating increased confidence in this new segment of the new space economy, particularly considering the ISS’ decommissioning towards the end of the decade.”

Going global: While investment has increased globally in the trailing twelve months (TTM) period, investment in North American (mainly US) companies remained relatively flat, and the region was the only one to experience a “slight pullback,” the report said.

Investment has increased in both Europe and Asia, as well as in the rest of the world, in the last TTM period compared to the one before. Investment in the Asian space economy has increased 60% and surpassed the volume of European investment over the last 12 months.

- The UK’s investment growth is particularly notable, nearly doubling the amount funneled into the domestic space economy YoY, with a particular focus on climate tech.