Federal officials are emphasizing the need to boost cooperation with nontraditional aerospace companies. New space fans from Elon Musk to Jared Isaacman are poised to play an influential role in the Trump administration. Where does that leave the major primes that have built decades of US aerospace and defense programs?

“If I was at a large established prime that’s 20+ years or older, I would be in the war room thinking about how the hell we’re going to deal with this,” one space industry source told Payload. “They have a clear preference for the Andurils of the world.”

We may find out more this week as primes, including Boeing (which is already predicting a $4B loss on the quarter), Lockheed, Raytheon, and Northrop Grumman, prepare to announce their Q4 and full-year earnings—and field questions from analysts and investors about their future.

A new handbook? Outgoing DoD space acquisition chief Frank Calvelli shared his thoughts last week on how the Pentagon buys space hardware. Some recommendations in the four-page doc—which range from incremental delivery of tech to making primes responsible for subcontractor-driven delays—could spell bad news for defense primes, according to one source.

“There’s a lot of detailed acquisition reform stuff that does not look good for traditional defense players. There are a lot of rational people who will look at that and say, this is right,” a second space industry executive told Payload. “The incoming Trump people, I think, will be open to acquisition reform.”

The Defense Innovation Board also released two studies this month looking at how DoD can do a better job rapidly fielding emerging tech and working with new partners. They recommended things like broadening the scope of DIU and giving more funding flexibility to contracts for non-traditional Pentagon partners.

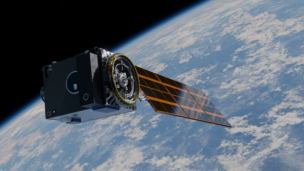

The other side: Despite this, some companies believe they are well positioned to succeed in the Trump administration. Lockheed Martin highlighted recent changes it made to boost innovation, including building a new facility to speed up sat production and investing in self-funded demo missions.

“A renewed government focus on streamlining procurements and reforming regulations will allow us to enable this business transformation while also maintaining the mission success that is our hallmark,” Bob Behnken, Lockheed’s VP for exploration, product and technology strategy told Payload in a statement. “Fixed price procurements, services, and other non-traditional approaches that consider financial viability, technical workforce availability, and past performance can be a win for both the US government and industry.”

A new role: Primes are the ones building expensive, exquisite systems for the government, and that’s unlikely to change, according to some sources. Startups, in all likelihood, won’t take on big ticket, critical items such as a GPS satellite or the James Webb Space Telescope.

Additionally, some experts predicted that primes could play a larger role by leaning into their investment arms and acquiring startups at an earlier stage.

“I wouldn’t be surprised if you see the established primes leaning more into M&A activity, and even if they start reaching further up field and acquiring companies at earlier stages than we typically see today,” said Matt Weinzierl, a Harvard Business School professor and co-author of the upcoming book Space to Grow.

Shifting tides: Others predicted that primes could work on government systems as subcontractors, allowing startups to become the new primes. This is already starting to happen on some missions, such as NASA’s program to build a lunar terrain vehicle where traditional companies are subcontractors to startups.

“There’s an optics piece of it,” the industry executive said. “Having one of the new space companies be the lead, there’s an optics piece that makes that more palatable.”

Correction: This story has been updated to correct the spelling of Bob Behnken’s name.