The aerospace and defense primes had a busy Q3 marked by massive SDA contracts, growing space divisions, and a few hiccups along the way. Today, we dive into Lockheed, Northrop, and Boeing’s Q3 earnings.

Lockheed Martin

Lockheed’s overall sales hit $16.9B this quarter. The space division posted $3.1B in sales—18% of total sales and an 8% YoY increase. The company attributed this space surge to higher sales in key programs including:

- Next Generation Interceptor and Fleet Ballistic Missile

- GPS III

- Orion

The division generated $259M in operating profit.

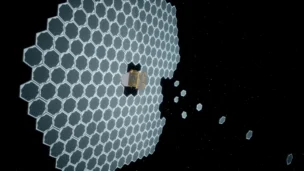

The SDA bag: This summer, Lockheed Martin won an $816M SDA contract to build 36 tranche two satellites for the Pentagon’s Proliferated Warfighter Space Architecture (PWSA). Earlier this week, the company turned around and awarded Terran Orbital the contract to build the satellite buses for the contract.

Lockheed maintains a significant equity investment in Terran Orbital, whose shares have declined 65%+ over the last year to below $1.

Next Up: Northrop Grumman

Northrop Grumman posted Q3 sales of $9.8B, a 9% YoY increase. Northrop space grew 11% to $3.5B, leading all divisions in growth rate and sales volume. The following programs drove space revenue:

- Ground Based Strategic Deterrent

- Next Generation Interceptor

- SLS

- Next Generation Overhead Persistent Infrared Polar

Growth was partially offset by weakness in work on NASA’s lunar gateway HALO program.

“For space in particular, we have approximately doubled that business in the last five years, so it’s been just on a tremendous growth tier,” Northrop CEO Kathy Warden said on the earnings call.

The gift that keeps giving: Similar to Lockheed, Northrop secured a ~$733M SDA mega contract to build 36 tranche two satellites. The company is now building nearly 100 satellites for the PWSA.

On to Boeing

Fixed price contracts from programs such as Starliner continue to weigh on Boeing’s profitability.

Fixed price allergies: Boeing’s space and defense division lost a whopping $924M in Q3, with management taking aim at those pesky fixed-price contracts. “Rest assured, we haven’t signed any fixed-price development contracts nor [do we] intend to,” said Boeing CFO Brian West. The statement comes at a time when NASA is going all-in on fixed-price contracts.

Starliner: In August, the aerospace giant announced that Starliner will be ready to fly in March 2024—perhaps this time for real.

- “For commercial crew, while it has been a long road, we’re preparing to execute a successful crude flight test next year and then fulfill operational launch commitments, all of which will be completed as we exit 2025-2026,” said West.