ARK Space Exploration & Innovation (ARKX) is an ETF managed by the eponymous, iconoclastic, and currently down-bad NYC fund manager ARK Invest. The space ETF launched at the end of last March, so it just recently celebrated its first bday. Time for a check in…

- At the end of Q1, ARKX’s assets under management stood at ~$420M, an ~11% dip from the prior quarter.

- The bright spot, if you can call it that, is that the space fund outperformed its sibling ARK ETFs in Q1. ARKX finished the first three months of 2022 down just 4.9%, while the others fared more poorly and posted double-digit declines.

Methodology

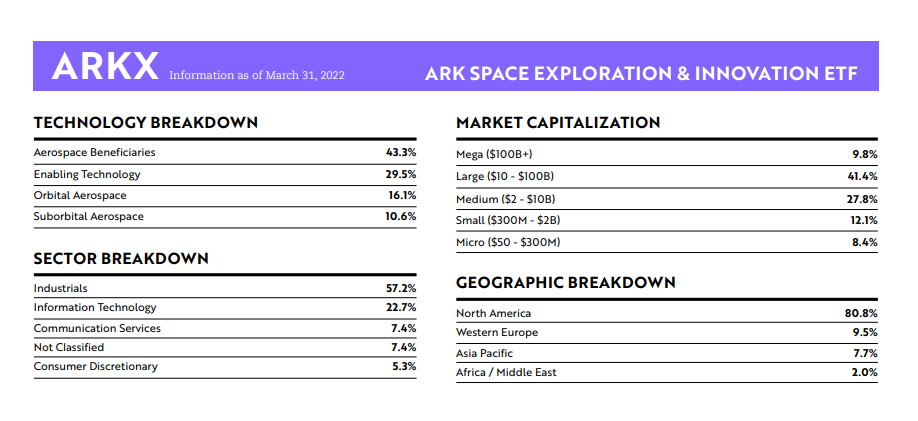

ARKX is broken down into four themes.

- Orbital (#1) and suborbital (#2) space companies are self-explanatory.

- “Enabling technologies” (#3) spans AI, 3D printing, energy storage, and more—this is the cutting-edge stuff that goes into the aerospace supply chain.

- “Aerospace beneficiaries” (#4) is those who stand to disproportionately benefit from satellites and on-orbit assets, ranging from farmers to flying car makers.

- The Q1 2022 weighting: Aerospace beneficiaries @ 43%, Enabling technology @ 30%, Orbital aerospace @ 16%, and Suborbital aerospace @ 11%.

ARK’s methodology gives it some leeway in picking holdings for the space exploration fund. In Q1, among the ETF’s biggest detractors were software companies and a logistics service provider.

Upshot: As we wrote a few months ago, “while ARKX is by no means a pure-play ETF, it has still…introduced aerospace names to retail traders (for better or worse).”