Loft Orbital, an SF-based space infrastructure-as-a-service startup, has announced a $140M fundraising round led by BlackRock, with participation from CEAS Investments, Foundation Capital, Uncork Capital, Ubiquity VC, and others.

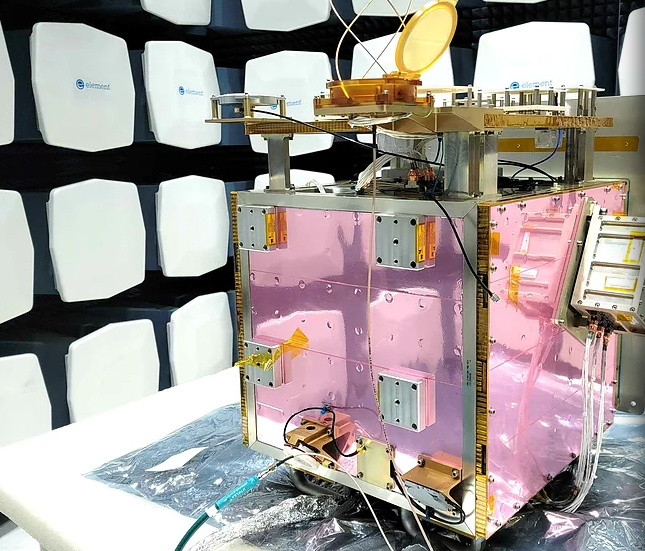

Loft 101: The startup abstracts away the complexity of going to space by handling payload integration, satellite launches, regulatory compliance, ground stations, data transmission, and on-orbit compute for end customers. The company has developed a software/hardware suite that lets it integrate and aggregate customer payloads with common satellite buses.

- The company’s Payload Hub is a universal interface that reduces “supply chain risk” for customers, Loft COO and cofounder Alex Greenberg told Payload.

- Cockpit, Loft’s other product, is a highly automated engine for mission control.

- The endgame = “truly eliminating any non-recurring engineering, customization, or design” costs for customers.

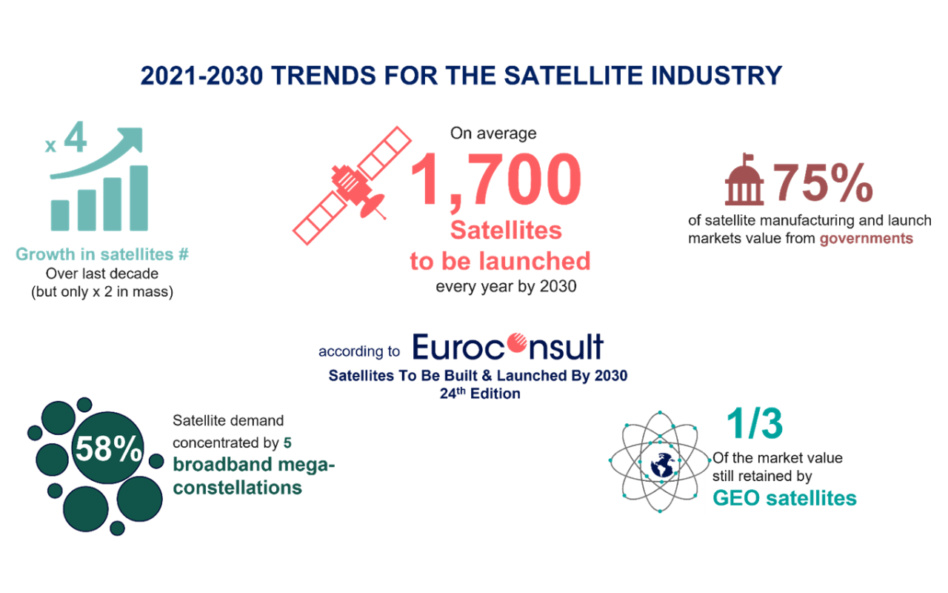

Loft’s approach enables standardization and economies of scale, per Greenberg, as it can buy and hold satellite busses in inventory. The newfound capital will enable Loft “to make more bulk buys that are pretty significant,” Greenberg said. When launched, those satellites go by the name ‘YAM,’ which stands for Yet Another Mission.

An Earthly analogy: Loft sometimes refers to itself as AWS (Amazon Web Services) for space. The company doesn’t compete with customers at the application layer—ie, remote sensors or comms equipment—but rather, provides a payload-agnostic platform, Greenberg said.

- Loft’s customer base spans the commercial, civil, and military space. “We’re currently more weighted toward commercial,” Greenberg said. In the coming months, the company plans to ramp up contracts with government/military customers as a subcontractor or outright contractor.

- Loft uses a “pay for performance” pricing model, which is perhaps “the most disruptive part of our business,” per Greenberg. If YAM’s performance is degraded on-orbit, then customers won’t get charged as much.

+ On institutional investment: While Loft has plenty of existing and new VCs on its cap table, the startup is crossing the chasm to crossover funds and public market investors. BlackRock leading Loft’s round indicates that the startup—and commercial space, writ large—are “getting out of just the venture ecosystem,” Greenberg said.