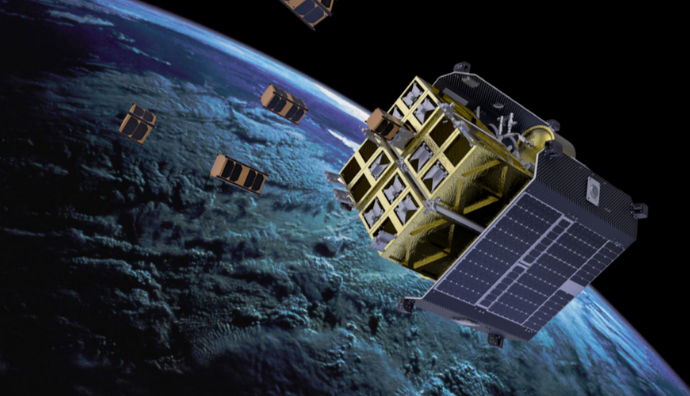

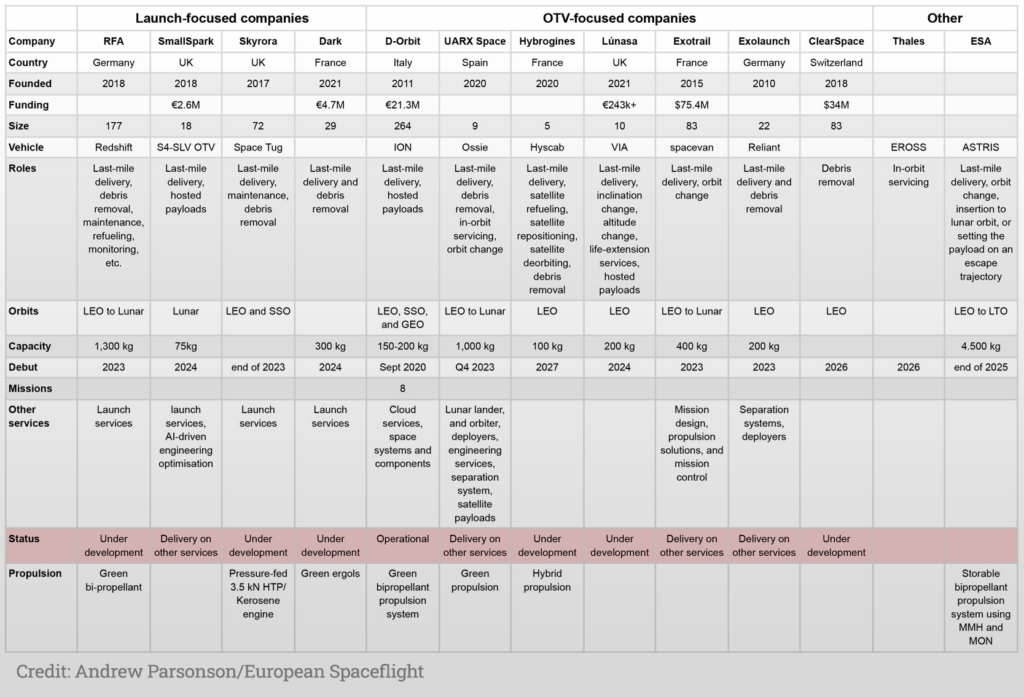

Today in Europe, there are no fewer than 13 companies developing or operating orbital transfer vehicles, known in short as OTVs or more colloquially as space tugs.

Around the world, we assess that there are likely north of 100 companies that are keen to grab a slice of the space tug market. With healthy competition in both the US and Europe, the race to operational flight is well and truly underway.

The latest edition of Europe in Space took an in-depth look at Europe’s OTV players, the vehicles that they are developing (or currently flying), and the services these companies plan to offer.

European space tug players: the full market map

Key takeaways

- D-Orbit is a pioneer of last-mile orbital dropoffs, not just in Europe but around the world. The Italian company got its start in 2011 and has completed eight operational missions. D-Orbit launch three tugs in January, including two on Transporter-6.

- There are currently no European launch startups pursuing mission extension services. However, the European Commission-backed Thales Alenia Space EROSS project will compete with Northrop Grumman’s MEV, or Mission Extension Vehicle. MEV first launched in 2019.

- ClearSpace is the only other European company pursuing an OTV project without last-mile delivery as one of its primary services. The startup’s vehicle is designed to be a debris removal robotic specialist. ClearSpace-1, the company’s first mission, is expected to lift off in 2026.

- Four European launch startups are pursuing the development of OTVs/kick stages to offer a wider range of mission options to their customers.

Want to go deeper?

Read the full, 2,000+ word analysis here.

This story was updated to note that D-Orbit launched three ION Satellite Carriers in January, rather than two.