Momentus ($MNTS) is in a race against its cash burn.

That’s the read from the space tug developer’s Q4 results, which portend a runway crunch in the coming year. At the same time, though, Momentus touted key new customer wins and a clean bill of health for its Vigoride-5 space tug. And it also has two more Vigoride missions on the books for 2023.

Momentus Q4 2022 Results

- Adj. EBITDA loss of $15.5M

- Net income loss of $24.4M

- $61.1M of cash/equivalents to close out 2022

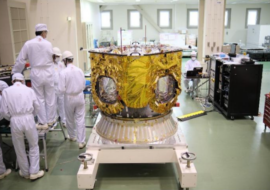

Vigoride-5 update: Momentus launched its second Vigoride tug in early January aboard SpaceX’s Transporter-6. Unlike Vigoride-3, the tug’s first flight last year, Momentus was able to power up the orbital transfer vehicle (OTV) and establish communications.

Two months later, the vehicle is in good condition. Momentus will soon test its powered flight capabilities, before deploying a Qosmosys payload in its designated orbit. Vigoride-5 is also carrying a Caltech solar power hosted payload, which the tug will continue to support.

A Bumpy Ride

Momentus has faced challenges during its two years as a public company, including two major lawsuits, a costly separation agreement with its founders, and the loss of communication with its first Vigoride flight. “Retirement of these issues clears the way for Momentus to continue progress on its vision to provide backbone infrastructure services for the growing space economy,” said CEO John Rood in February.

Customer ups and downs

- Momentus reported several recent customer wins, including deals with CONTEC, Australian Research Council Training Centre, and a two-mission agreement with Fossa.

- These wins only partially offset a slumping backlog, which has decreased from $67M at the start of 2022 to $33M by year-end.

Cash Burn

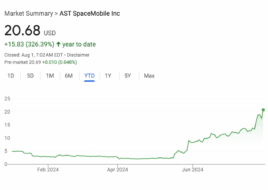

Management and investors have zeroed in on the company’s $6.8M monthly cash burn. Momentus had $160M in cash at the end of 2021; $81.6M at the end of Q3 2022, and $61.1M on Dec. 31.

“We believe the company has sufficient liquidity to meet its needs for the next 12 months,” interim CFO Dennis Mahoney said on Tuesday’s earnings call. Momentus plans to tap capital markets to avoid a liquidity shortfall, but with a market cap of ~$61M and shares trading below $1, more funding may come at a steep price.

+ Stock pulse check: $MNTS is down 17% year-to-date and 66% over the last year. Shares of $MNTS were off 4% on Tuesday. In pre-market trading, the stock is up 2.8%.