Antitrust cops have stepped in to block Lockheed Martin’s (NYSE:LMT) proposed $4.4B takeover of Aerojet Rocketdyne (NYSE:AJRD), the US’s last-standing large independent missile- and rocket-motor maker.

The FTC sued Tuesday to block the deal, which was announced in December 2020. Aerojet shares dropped nearly 19%, while Lockheed finished the day up 3.7%. Strategically speaking, the acquisition would give Lockheed a beachhead in the space and hypersonic propulsion supply chain. On a broader level, if realized, the transaction would be the latest mega-move in a long trend of defense consolidation.

But!!! The FTC says the deal could adversely impact US national security and shut off Lockheed rivals’ access to Aerojet engines. Fleshing out the FTC’s POV…

- The antitrust agency sued to prevent consolidation sweeping over “our nation’s last independent supplier of key missile inputs,” FTC Bureau of Competition Director Holly Vedova said in a statement.

- “Without competitive pressure, Lockheed can jack up the price the US government has to pay, while delivering lower quality and less innovation,” Vedova added.

- Should the deal go through, the FTC alleges that “Lockheed will use its control of Aerojet to harm rival defense contractors and further consolidate multiple markets critical to national security and defense.”

- FTC Chair Lina Khan has indicated the agency would be resistant to vertical mergers…and inclined to challenge deals outright than impose divestitures, restructuring, or other remedies (such as requiring Lockheed competitors’ continued access to Aerojet products).

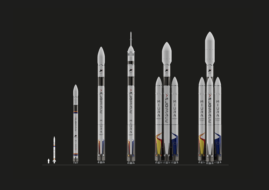

While the FTC’s suit is couched in defense consolidation terms, Aerojet is a pivotal space propulsion player. The California-based company counts NASA, ULA, Boeing, Raytheon, and (of course) Lockheed as key customers.

Dead on arrival? Lockheed has yet to clearly indicate whether it will defend or abandon the deal, which is a “less than full-throated endorsement,” JP Morgan analysts wrote in a note earlier this week (prior to the FTC’s announcement).

- If the Pentagon supports the merger, the analysts wrote: “We see at least some chance that Lockheed would stick with it.”

- The DoD reviewed the deal and provided its assessment, the FTC said.

Looking forward…Lockheed and Aerojet have 30 days to determine whether they will stand by or walk away from the deal. Should this thing go to court, the trial would start in mid-June.