Momentus ($MNTS) notched a number of key milestones this quarter, but continues to stare down a dangerously depleting cash reserve, the company revealed yesterday in its Q1 financial results.

By the numbers:

- Cash as of Mar. 31 = $38.6M

- Net income = -$20.8M

- Backlog as of Apr. 30 = $33M

- Momentus generated minimal revenue this quarter

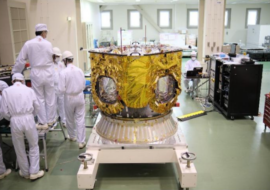

Proving out space tug: The company has two functioning spacecraft in orbit. “We are now operating Vigoride-5 and Vigoride-6 concurrently, and both missions mark key milestones in demonstrating the value proposition of our technology,” said Momentus chief John Rood.

- Momentus also hit a major milestone earlier this week by raising the Vigoride-5 spacecraft orbit using its water propellant thruster.

Cash Burn

Momentus is inching towards bankruptcy. The company has been burning cash to the tune of $8M per month over the last year.

- Extrapolating the cash burn, the company has roughly five months of runway.

Payload’s take: With a current market cap of ~$40M, equivalent to the total cash on hand, raising additional funds will be a challenge. The company also faces a Nasdaq de-listing, which would further limit access to capital pools if executed.