Image: Niall David/Momentus

Even if most of us may not want to think about financial markets right now, earnings season is in full swing. Let’s run through four results from this week, bucketed into two categories.

Space transportation

Momentus ($MNTS) reported $0 in Q1 revenue on Monday and a $26M net loss. There’s a lot riding on the success of its first Vigoride orbital transfer vehicle, which is slated to launch on a Falcon 9 later this month. The vehicle, which recently gained full regulatory approval, is fully integrated with Falcon 9 and “go for launch,” Momentus said today.

Moving right along to Virgin Orbit ($VORB)…Tuesday, the air launcher reported $2.1M in revenue, down 61.8% YoY. Virgin attributed higher sales from Q1 2021 to “launches contracted during early development phase with introductory pricing.” Net loss nearly doubled YoY to ~$63M.

- Looking forward, the company touted upcoming launches, new contracts, and the flexibility of its launch system:

- “With the escalating geopolitical environment, our ability to launch from airports around the world has attracted growing interest,” Virgin Orbit CEO Dan Hart said. “The differentiated capabilities of our system can uniquely serve the national security community and our allies.”

Now, for Earth observation

BlackSky ($BKSY) revenue grew 91% YoY to a record $13.9M for the defense/intelligence-focused EO company, with “imagery and software analytical services” revenue jumping 63% YoY.

- In Q1, BlackSky booked a net loss of $20M.

- It ended the quarter with ~$138M in cash.

- For more on BlackSky, read our recent Q+A with CEO Brian O’Toole.

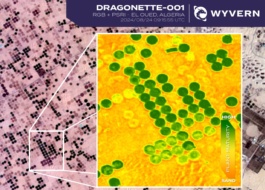

Spire ($SPIR) reported revenue of $18.1M (+86% YoY) and annual recurring revenue (ARR) of $81.6M (+134%). Spire’s GAAP operating loss was $20M (+56% YoY), and the company ended Q1 with ~$92M in cash on hand (a 16% quarterly drop).

- Non-GAAP operating loss beat guidance by $2M at $12.8M.

- Both quarterly revenue and ARR topped Spire’s previously provided guidance.

- Spire added 29 net new customers.

- They grow up so fast: In January, Spire saw six of its satellites launch with separate providers just six hours apart. One of those launches included Spire’s 150th satellite, which has 100X more processing power than the company’s first-gen system.

- Fun fact: Spire touted a “top Formula One team” as a key customer win. The F1 team uses Spire’s weather data to help inform preparation and race day decisions.

- Looking forward: Spire guided to $18M–$19M in Q2 revenue, and $85M–$90M for the full year.

Widen the aperture: Even with the EO companies posting their strongest quarterly results yet, the path to profitability still appears to be a long and winding one. And investors have been unrelenting in their bearish judgment of space SPACs.