The space industry has grown rapidly in recent years, and a new report from Novaspace suggests that things are just getting started.

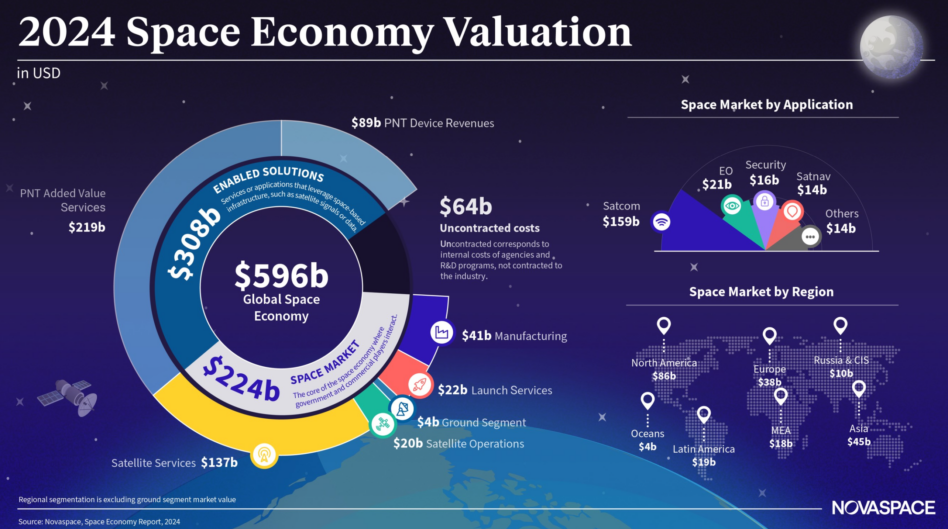

The report, released yesterday, predicted that the global space economy will reach $944B by 2033. The growth will be primarily driven by the increased adoption of downstream technologies such as AI and cloud computing, which make space data more accessible to businesses. In 2024, the global space economy was valued at $596B—meaning if their prediction is true, the industry will grow by 1.5 times in fewer than 10 years.

Snapshot: Novaspace’s gauge of the space economy in 2024 revealed that downstream solutions—the services and applications which leverage space-based infrastructure and data—already account for over half of the current valuation. The upstream sector, by comparison, includes launch, satellite manufacturing, and ground stations.

As more hardware heads to orbit to provide these capabilities—from advanced EO sats to satcom megaconstellations—terrestrial companies get more and more data to analyze and sell.

This reality is most stark in Asia, where satellite services make up nearly two-thirds of the space industry. In a region where sovereign launch and manufacturing is either relatively new or nonexistent, the satellite services market has carved out a name for itself by leveraging the space data generated on orbit.

The projected growth, however, isn’t guaranteed. Inflation, supply chain disruptions, and the success or failure of new entrants in the launch sector remain barriers for the space economy to reach its full potential.

Follow the money: While the commercial sector is driving value in the overall space market’s valuation, government spending in that sector remains a pivotal source for future growth. Luckily, governments around the world are stepping up their military space budgets, which currently exceed $64B worldwide—generating contract opportunities for business.

For now, the US dominates the space market, comprising the largest market share for both upstream capabilities (launch, satellite manufacturing, and ground segment operations) and downstream capabilities (satcom, EO and PNT) globally.

However, the future may see a more evenly distributed global market, as government spending on space in the EU and Asia grows at a faster rate than in the US—which is currently mulling the largest NASA funding cut in the country’s history.