Marco Fuchs, CEO of the German A&D prime OHB, plans to participate in the antitrust process against the proposed merger between Airbus, Thales, and Leonardo—to make a case that the merger would be bad for the European space industry.

“We will be vocal about our view that we think that this is limiting competition,” Fuchs said in an interview with Payload yesterday. “We are concerned, and we will participate in the antitrust process against it.”

Building the case: OHB isn’t alone in the view that the proposed pan-European merger could be bad for business. European VC investors told Payload last month that—while the merger would have little short-term impact on new space startups (who rarely compete head-to-head with A&D primes)—the new entity could become a magnet for large government contracts.

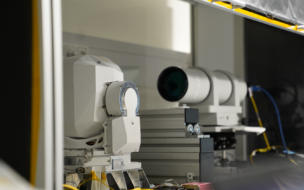

For OHB, the situation is more complicated. The prime often competes for large contracts against Airbus, Thales, and/or Leonardo. In some cases, however, OHB has subcontracted Thales Alenia Space (a joint venture between Thales and Leonardo) for critical components on major missions—including on the LISA (Laser Interferometer Space Antenna) mission, and on future Copernicus EO spacecraft.

As Fuchs sees it, the merger could have a negative effect on OHB’s supply chain.

“It is negative in the sense that it impacts our established value supply chains—and our value creation reality that we have for European Space Agency business with Thales,” Fuchs said. “We want to safeguard our supply chain. So, we want to make sure they compete. We want to have a level playing field.”

Crushing it: The Airbus, Thales, and Leonardo merger will grind its way through regulatory and antitrust approvals, and isn’t expected to be finalized until 2027, giving OHB ample time to position itself to meet the new challenger. Already OHB is making moves.

In August, OHB reported that its backlog had surpassed €3B for the first time in the company’s history. In the short term, OHB has already started ramping up its production capacity—both to meet its obligations, and to capitalize on Europe’s increasing investment into space.

OHB announced two acquisitions in the last week intended to bolster the company’s ability to locally manufacture space components and infrastructure.

- OHB completed a full takeover of MT Aerospace on Oct. 29, by purchasing the final 30% of the company to become its sole shareholder. MT Aerospace is Germany’s largest supplier to the Ariane 6 program, and has a contract with ArianeGroup to deliver components for 27 upcoming rockets.

- Two days later, OHB announced the acquisition of TechniSat’s manufacturing plant in Schöneck, Germany, where OHB plans to expand electronic-component production for the space industry. The acquisition was an “opportunistic move,” which allowed OHB to take over a production facility for a fraction of the cost it would have taken to build its own, according to Fuchs.