Hyperspectral imaging startup Pixxel has raised a $25M Series A led by Radical Ventures. Also joining the round were Seraphim, Lightspeed Partners, Blume Ventures, Sparta LLC, and Relativity cofounder Jordan Noone. Payload caught up with Pixxel CEO and cofounder Awais Ahmed over email to hear more about the company’s product roadmap, development principles, and target markets. NB: This interview was slightly edited for clarity and length.

What percent of your constellation will be funded by this raise?

~1/6th of our total constellation size, at its maximum. These 6 satellites will help us cover the entire globe almost every 2 days. With the additional satellites, we will increase coverage to every 1 day or less and increase collection capacity.

What have you done differently that enables you to launch and deploy in such a capital-light manner, relatively speaking? Do you adhere to the agile development philosophy of satellite-building?

We do follow an agile development philosophy. Our launch last year was for a small MVP [minimum viable product] camera, or, the first iteration. Our second iteration launched this year with two more demo satellites. The third iteration will follow in the first 6 satellites, which will be the constellation’s first phase. We also leverage India’s low-cost supply chain to keep costs low without compromising on quality a whole lot.

To what extent is your business model and product roadmap made possible by secular, non-space specific tech trends? (ie, Moore’s law, smartphone manufacturing at scale and miniaturized parts’ cost curves, cloud, etc). And what space-specific trends are tailwinds?

The reduction in sensor sizes (specifically the number of pixels that can be fit into as small a sensor as possible) has made our cameras lightweight and compact comparatively. The sensors also consume lower power these days than previous models. This helps keep our satellite relatively smaller and light. Deployable and more efficient solar panels help make our satellites very capable even with smaller sizes. The lower the satellite size, the lower the launch cost with SpaceX and others.

As you build out your stack, what % is build vs buy? How vertically integrated are you today, and how could that change over time?

Almost all of our constellation design and engineering is in-house, while manufacturing of various components happens globally. We do not want to reinvent the wheel. For example, we procure solar panels from Europe, some controller boards from Canada, and optics from India, etc. These are specialist vendors specializing in each component. We then integrate the satellite in-house completely as well as write all the software in-house. Testing and operations of the satellite are all internal too. We will continue to leverage the same model where we architect and manufacture the satellite as a whole but the components themselves are procured globally.

Can you give the layperson’s elevator pitch (or ‘explain it like I’m five’) for why high-res hyperspectral matters?

If you thought you had a broken bone, you would not use a normal iPhone to tell whether it was broken or not and how bad the break was. We need X-Rays for that. Similarly, to see things happening around our planet, we can’t only rely on our eyes and existing imagery.

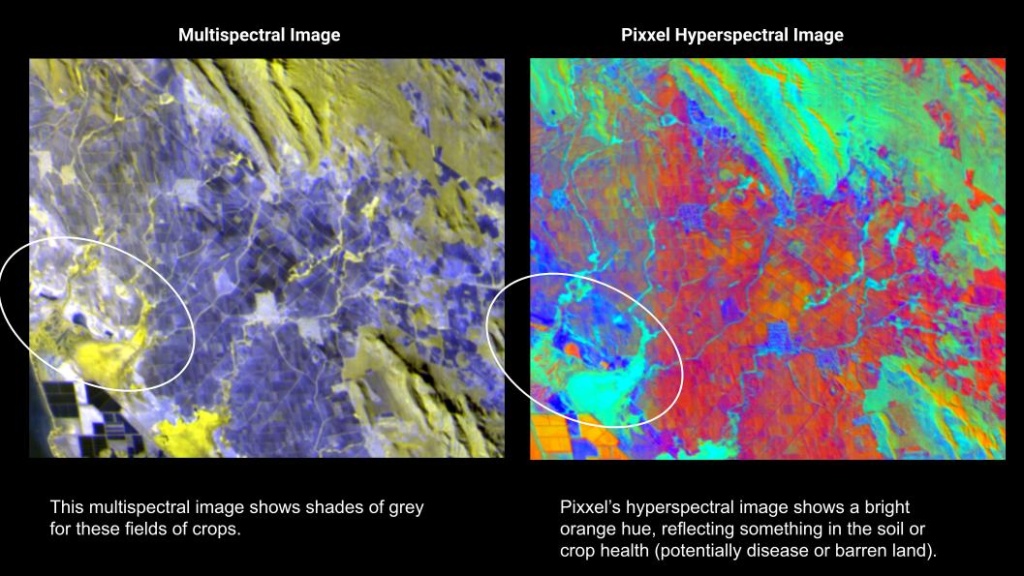

We need hyperspectral imagery that can help us see things changing within plants, soil, and air even when they are not visible to our eyes or existing satellites. Hyperspectral imagery gives us that penetrating power needed to actually see the invisible problems in the first place, thereby helping us solve them.

Can you walk me through how what you’re doing is an advancement over the competing EO modalities and the status quo in sensor stacks?

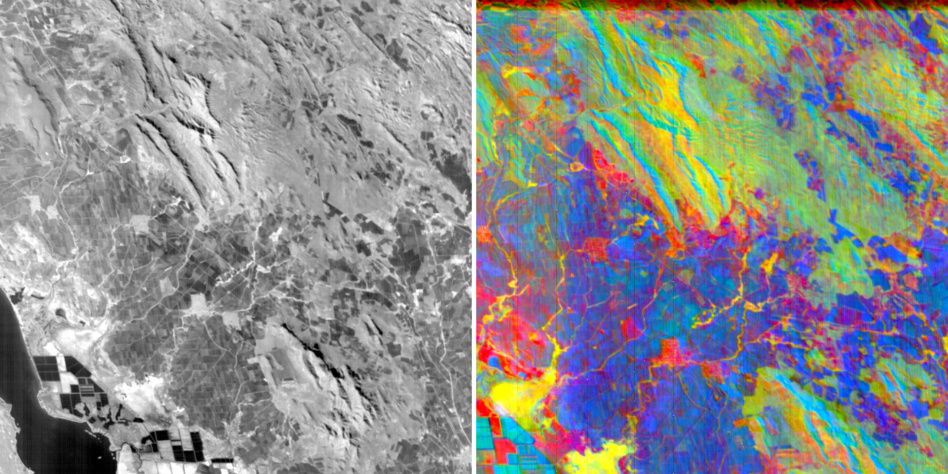

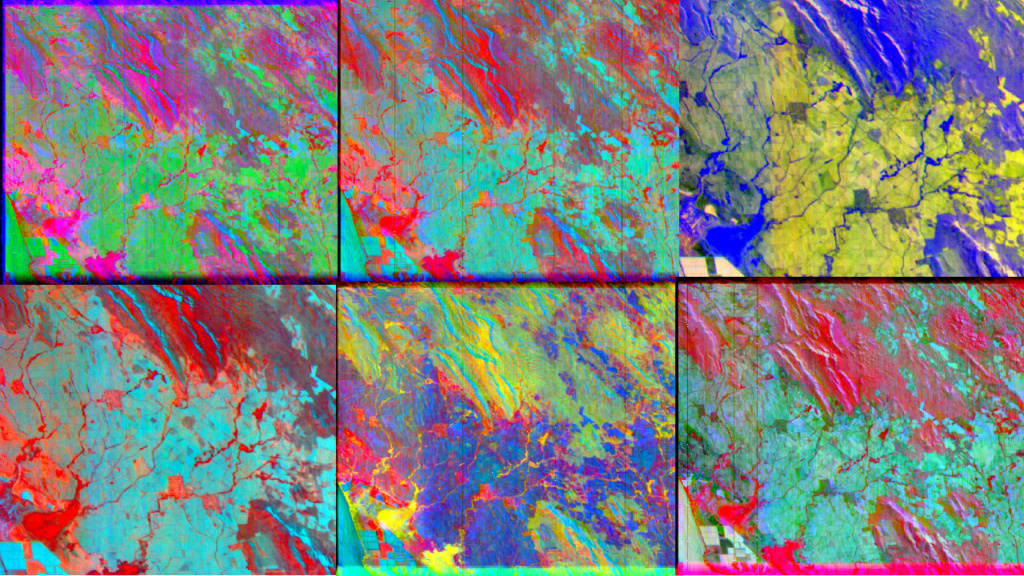

Firstly, we are increasing the number of bands in which we capture data from the 20 possible with today’s multispectral satellites to over 200 bands. Planet, for example, captures only 8 bands today. Pixxel’s hyperspectral sensors however collect several hundred “slices” of the spectrum, enabling us to see things within each of those slices, thereby increasing the amount of data that can be extracted.

Second, compared to the limited number of hyperspectral satellites launched by NASA, ESA, and ISRO, Pixxel is bettering the spatial resolution from 30 meters to 5 meters. As most customer use cases require 5 meters or better data, this is a colossal shift.

What are your key initial use cases and market verticals?

The verticals include agriculture, oil and gas, mining, and climate, with use cases like soil nutrient mapping, crop species identification, gas and oil leaks from pipelines, and forest fire probabilities.

What’s the share between military, civil, and commercial convos you’re having and/or contracts you’ve signed?

Of the 50+ customers we have on board, our customers are almost all commercial today (>95%).

Given wider macro backdrop, with public market drawdowns and spillovers into private market, was it difficult to close this round in 2022?

Not particularly. We ran a tight and efficient process and brought onboard investors who clearly understood the value proposition. Made the closing quite swift and easy compared to our last round (7.3M seed) that broke apart before coming together when COVID actually started in 2020.