Yesterday, Planet ($PL) reported nearly Q3 revenue and projected an annual haul of nearly $200M. The results speak to “strong execution across the company and the mission-critical nature of our data,” CEO Will Marshall said.

To start…

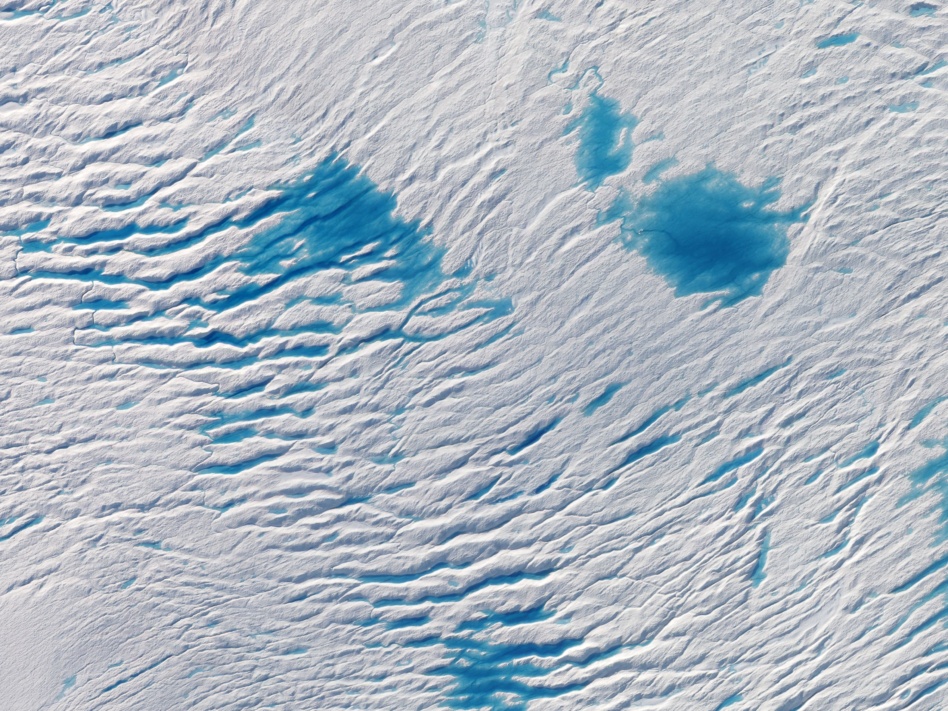

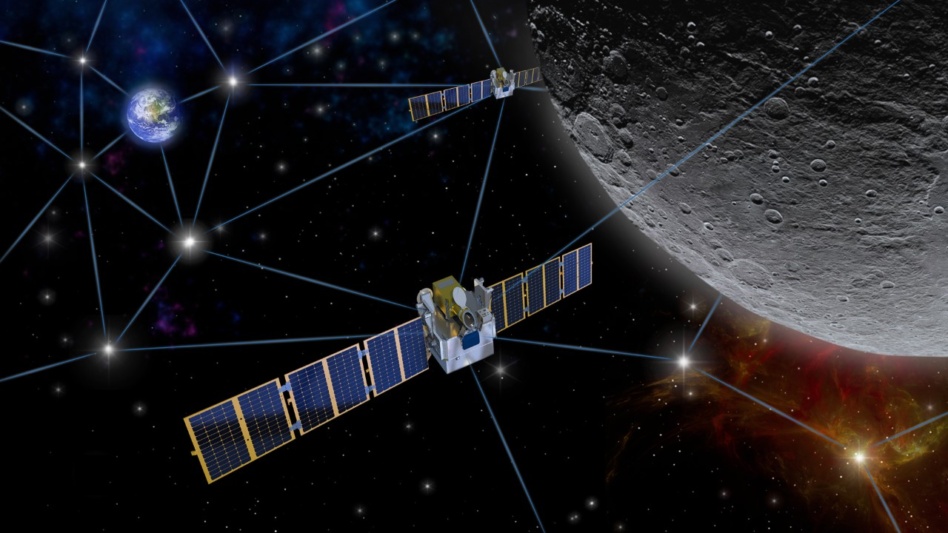

…the self-described “Bloomberg terminal for Earth data” would point you to its scale. Planet is currently flying ~200 satellites, images roughly twice the area of Earth’s land mass daily, and each day captures 30 terabytes of data, 100% of which is ready for machine learning analysis.

GAAP and non-GAAP results

For the fiscal third quarter ending Oct. 31, 2022, the EO giant reported $49.7M in revenue, representing 57% annual growth. Other key metrics were as follows:

- Planet had $425M in cash/equivalents on Oct. 31.

- Gross margin was 50%, compared to 37% in Q3 21

- The firm’s net loss was $40.2M, while adjusted EBITDA was –$12.4M.

- The company had 864 customers (+ 16% YoY). Here’s the breakdown:

$PL-specific results

Due to the subscription-based nature of its business, Planet breaks out SaaS-style metrics that may be less familiar to space investors. For Q3, Planet reported a 94% recurring ACV and a 125% net dollar retention rate (NDRR).

- ACV, or annual contract value, measures subscription revenue for contracted customers, normalized by year.

- NDRR measures retention of existing customers, and a company’s ability to upsell, or generate additional bookings from them.

Partners on partners: Planet pointed to new Q3 partnerships with Accenture, AWS, and Microsoft. It also highlighted 2022 humanitarian and climate initiatives, ranging from sharing imagery with Kyiv to presenting data at the UN’s COP27 conference in Sharm El Sheikh, Egypt.

Surprise M&A

Planet has agreed to acquire Salo Sciences for an unknown amount. The SF-based climate tech startup uses Planet products for forest carbon measurement and other environmental use cases. The deal, set to close early next year, will help Planet on its continual quest to move “up the stack” from EO data to analytics/insights.

A near-bullseye

18 months ago in its July 2021 SPAC investor deck, Planet predicted $191M in FY 2023 revenues. Then, yesterday, Planet management guided to FY 23 revenues of $188M-$192M (BTW…Planet’s fiscal year ends on Jan. 31).

$191M vs. $188M–$192M…is as close to a 🎯 as you’re gonna get. “From our perspective, as we went public, we tried to treat it like any other public offering,” Planet President of Product/Business Kevin Weil told us on Pathfinder #0008 (the subtext here being that some space SPACs were less responsible with expectation-setting). “And our goal was to be really thoughtful about how we set expectations for future growth.”

+ Stock pulse check: $PL is down 15% year-to-date and the company has a $1.43B market cap. In pre-market trading, the stock was up 4.6%.