It’s everyone’s favorite time of the year. We don’t mean the holidays—we mean earnings season.

On Monday, Rocket Lab ($RKLB) and AST SpaceMobile ($ASTS) released their financial results for the third quarter of 2025.

Rocket Lab outperforms: New Zealand’s favorite launch company outperformed analyst expectations in Q3 and raised its projections for the rest of the year. With new opportunities in defense and space systems, life is good for the launcher.

“With progress across our major space systems programs, record backlog of contracts for our launch services business, and well-timed, strategic M&A in growth areas that are well-aligned with next-generation defense programs like Golden Dome and the Space Development Agency’s future constellations, our momentum is strong and we’re poised to deliver long-term exciting growth,” CEO Peter Beck said in a release.

Rocket Lab’s quarter, by the numbers:

- $155.1M in total revenues—a $50.4M jump over last year’s number

- $509.7M in launch backlog with contracts signed for 49 launches

- Loss of three cents per share

- Adj. EBITDA loss of $26.3M

- $807.9M in cash on hand

Rocket Lab also has a yearly launch record within its sights. The company launched four times in the third quarter and expects to end 2025 with more than 20 total launches under its belt for the year.

$RKLB saw a brief jump in its stock price after the release, but it’s since leveled out to about the same price as before. The overall trend is positive, though—stock is up ~105% since the beginning of the year.

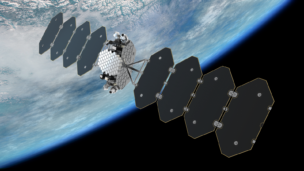

AST falls short: AST SpaceMobile’s quarter didn’t quite hit analyst expectations—though it’s had a banner year so far, with a number of key contracts and partnerships with the US government and top cell providers for its D2D services making headlines and keeping hopes high.

AST’s quarter, by the numbers:

- $14.74M in revenue

- $122.9M in net loss

- $1B in backlog secure this year

- $1.2B in cash on hand

The company missed its revenue expectations for the quarter, but expects to catch up in the last three months of the year—AST maintained its revenue guidance of $50–75M in second half earnings.

$ASTS’ share price remained largely unchanged after the earnings call. The company’s share price is down ~25% in the last month, but still tracking up significantly—at 214%—since the beginning of 2025.