Satellogic ($SATL) expects 2022 revenue to be in the $6M–$8M range, the EO satellite operator said in a Thursday business update. In H1 ‘22, “Satellogic took the most significant steps in our history towards realizing our mission, beginning to fully commercialize low Earth Observation,” chief executive Emiliano Kargieman said.

By the numbers

- Satellogic ended H1 with $124M in cash and expects to end the year with $78M–$82M.

- The new-ish “Space Systems” line touts <8-month satellite build-to-launch cycles.

- Asset Monitoring revenues grew at a 35% CAGR year-to-date.

- $SATL is currently flying 26 satellites and expects to launch “up to” 21 next year.

- At 6.2M km2 daily, Satellogic claims to have the “largest high-resolution commercial capture capability.”

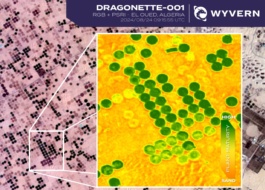

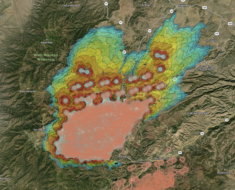

The highlights: Satellogic has rapidly padded out its management team and struck key partnerships (Palantir, Ursa Space, Kleos Space, Astraea, SkyFi, Up42, and more). It also bought multiple tickets to space from SpaceX. Finally, on the product side, asset monitoring is growing at a healthy clip and Satellogic seems to have found some early CaaS (constellation-as-a-service) traction, signing on Albania, Ukraine, and most recently, Mexico for the sovereign EO service.

The lowlights: Satellogic still has a ways to go before it reaches a critical mass of satellites to achieve weekly—and then daily—world remapping. And the EO operator still has some capex-heavy work ahead of it.

Zoom out: As Kargieman has told Payload in the past, “we see ourselves as a data company, not a satellite company.” EO data and services are poised to be a $7.9B market by 2031, Euroconsult finds in a recently released report.

+ To go deeper…listen to Pathfinder #0012 with Kargieman on YouTube, Spotify, or Apple.