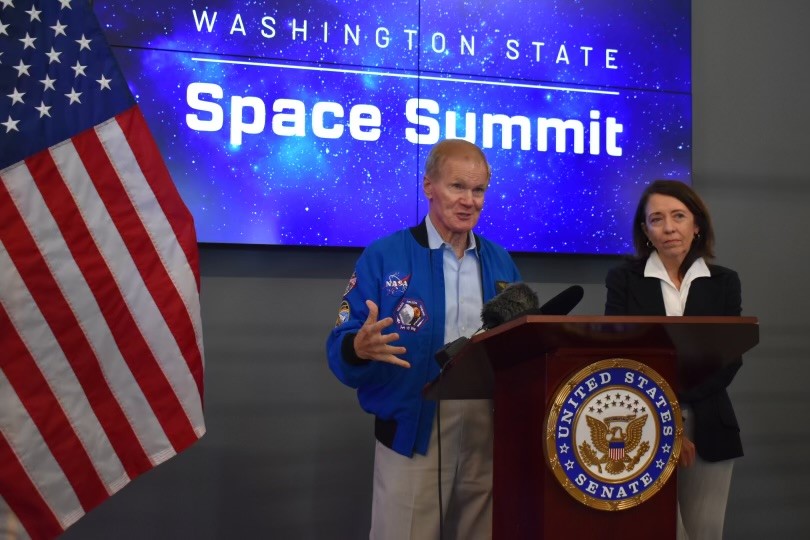

Nearly 20 regional space companies gathered at Blue Origin’s headquarters in Kent, WA, on Wednesday for the Washington State Space Summit.

Against the backdrop of the state’s booming space economy, which has more than doubled since 2018, NASA chief Bill Nelson flew in to share the stage with Sen. Maria Cantwell (D-WA), Blue Origin CEO Bob Smith, and other local space leaders for a panel on economic opportunities for the sector.

The gathering is the latest flex by a US state seeking recognition as a space hub in a bid to attract talent, companies, and investment into its star entrepreneurial cities:

- In June, Texas Gov. Greg Abbott signed into law the creation of the Texas Space Commission. The bill also invested $350M in developing the state’s space industry.

- In May, Florida Gov. Ron DeSantis signed a bill limiting the liabilities of private spaceflight companies.

Houston, we have a problem

The meteoric rise of the commercial space industry has summoned clusters and corridors of cities across the nation, all vying for a greater share of the action.

Some of these geographies offer fertile ground for a new crop of space startups to take root, presenting a threat to traditional hubs like Los Angeles, CA; Huntsville, AL; and Cape Canaveral, FL. These new clusters could siphon away not only resources—but also influence.

Most notably, the Seattle, Austin, and Denver metro areas are jostling for the title of “the Silicon Valley of space” and sowing the seeds for America’s next space hubs.

These up-and-coming space cities have all the right ingredients for success: a diverse ecosystem of stakeholders, a solid space infrastructure, and a rapidly growing cluster of prominent startups lured in by active economic development committees.

Blue Seattle

Wednesday’s summit in Washington hosted only a small representation of the more than 100 space companies in the region. One of them provided the venue for the meeting: Blue Origin.

As the Greater Seattle area’s largest space player, Blue is one of a few big anchors for the state’s $4.6B core space economy.

- Over 50% of NASA’s FY21 procurements directed at Washington went to Blue Origin.

- The company employs about 5,000 of the state’s 13,000+ aerospace workers.

- Blue Origin has spent over $1B in local companies, according to Cantwell’s office.

- And Cantwell touted their $3.4B NASA win to build a lunar lander as a boon for the local sector.

Though lacking a strong NASA and defense presence, the Greater Seattle area has the second-highest employment for aerospace engineers after LA, and the region seems to have found a niche in sats and lunar missions:

- Home to SpaceX’s Starlink and Amazon’s Project Kuiper, 50% of operational satellites in Earth orbit were made in the Greater Seattle area, according to Greater Seattle Partners, a public-private economic development organization.

- The region has 42 companies working on Artemis projects, and Blue Origin estimates their recent NASA win will support 1,000 local jobs.

Texas Triangle

Austin-based Firefly Aerospace acquired one of Seattle’s hometown heroes, Spaceflight Inc., last month.

Firefly, a potential beneficiary of the Texas Space Commission, recently won a $112M NASA contract for lunar delivery and is expanding its footprint in central Texas.

“The central Texas area is beneficial as Firefly’s headquarters for several reasons: It’s the hub of an incredible wealth of technology innovations and close to engineering-centric universities in Texas where we can recruit top-tier talent.” CEO Bill Weber told Payload, adding that the location also allows the company to operate its HQ, spacecraft facilities, and rocket test and production site all within a 30-minute drive.

Firefly told Payload it’s adding a new mission control room in North Austin and doubling the size of its “Rocket Ranch” testing facility in nearby Briggs, TX.

Known for having more lax regulation and lower taxes, Texas has a lot going for it:

- Texas accounts for 10% of the national space economy by jobs and 14% by GDP, according to Texas2036 and the Austin Chamber of Commerce.

- PwC ranked the state #1 for aerospace manufacturing attractiveness in 2022.

- And the state houses 18 of the 20 largest aerospace manufacturers.

But as the state’s center for tech and innovation, and home to UT’s top-10 ranked aerospace engineering program, Austin has been trying to prop itself up as an entrepreneurial spoke of the space hub taking shape within the Texas Triangle.

Bryce Bencivengo, a spokesperson for the Austin Chamber of Commerce, explained that each city in the triangle brings its own strengths: Houston is known for human spaceflight, astronaut training, and mission control; Dallas for engineering, manufacturing, and defense; and Austin for small sat manufacturing, software, and launch systems.

- The Chamber told Payload that Austin boasts 81 aerospace companies that employ a combined 13,000+ local workers.

- Other private space companies in the Triangle include Axiom Space and Intuitive Machines in Houston and SpaceX in McGregor.

But when Austin-based Albedo announced plans last month to open a new assembly, integration, and test facility in Denver, CEO Topher Haddad told Payload that access to talent led him to pick Colorado over Texas.

Colorado I-25

The Denver metro area and its neighbors have all the makings of a space hub:

- Public sector: A strong federal and defense presence, including NORAD, NORTHCOM, and US Space Command (the latter at least for now).

- Private sector: 1st in the U.S. for private aerospace employment concentration.

- Startups: 2/3 of the state’s 500 aerospace firms have 10 or fewer employees.

- Academia: The University of Colorado Boulder is the top NASA-funded school in the world.

- Convenings: Space Symposium offers a key annual conference for the sector.

Eclipsing Seattle as a budding lunar hub, over 180 firms in Colorado support the Artemis supply chain, and local NASA activity generates $4.5B+ in annual economic impact.

All in all, the Interstate 25 (I-25) corridor linking Boulder, Denver, and Colorado Springs—which runs all the way down to Spaceport America in New Mexico—is shaping up to become the nerve center of the nation’s space sector.

- However, Denver still ranks ninth among the nation’s metro areas for employment of aerospace engineers, and the state’s reliance on federal funding positions it less as a commercial hub and more of a center for national security.

Spaced out

Seattle, Austin, and Denver are just a few promising emergent space hubs readying for the next space age. Startup clusters have also sprouted in places like Long Beach, Phoenix, Northern Virginia, New Mexico, and Florida, to name a few.

New trends in the industry—from increasing spaceport congestion and supply chain disruptions to the rising influence of new space hubs—may also alter geographic strategies for companies looking to relocate or open their first facility.

Time will tell if this new breed of space clusters will unseat the “Space Coast” or “Space City” as America’s iconic space hubs.