Seraphim, a leading space VC, has published its 2023 market map, detailing the state of innovation in the in-space economy with an eye on the year ahead.

“As the in-space economy takes off, major players in the industry are positioning themselves to capture a slice of the burgeoning market,” Seraphim VP Maureen Laverty said in a press release. “The possibilities are endless, and the potential for returns is astronomical.”

Keep an eye out: Seraphim identified a few major areas where it expects to see innovation rolling and funding flowing in the coming year. Those areas include, in order of the size of the pool of companies competing as identified by Seraphim:

- In-space services

- Space infrastructure

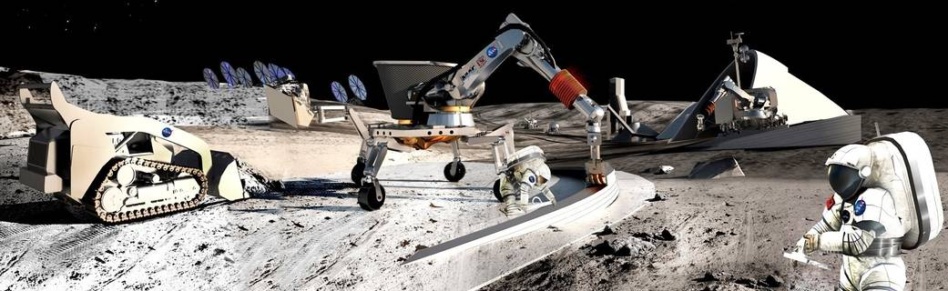

- Lunar technologies

- In-space R&D and manufacturing

- Crewed spaceflight

- Space exploration and utilization

Service, please: Far and away the largest area of growth is in-space services, which aid satellites “by providing transport, communication, life extension, situational awareness, or removing debris.”

- “This is driven by the explosion in the number of satellites launched, many of which will require ongoing support and maintenance,” reads the press release.

- “In-space communications feature almost every major GEO satellite operator or LEO constellation, as these companies aim to provide the replacement for NASA’s deep space communications system.”

And the state of competition for in-space services is certainly healthy. Seraphim identified 19 companies working on orbital transfer vehicles (OTVs), which carry customer satellites to their intended destinations to better leverage the cheaper costs of rideshares.

Debris removal and space situational awareness (SSA) companies should also see increased demand in the coming year, as the growing space economy increases concerns about safety and traffic management in orbit. Eight companies are working on active debris removal technology, including Astroscale, ClearSpace, and Altius, with familiar names focused on SSA.

Build a backbone: Space infrastructure rings in second in the state of competition. Anyone building a space station, capsule for in-space manufacturing or R&D, spaceplane, or power generator falls into this category.

To the Moon: As NASA makes its way back to the Moon, the space industry is also devoting more attention to the potential for a bustling lunar economy. In particular, the primes and more established players in space, including Northrop Grumman, Boeing, Blue Origin, and SpaceX, are working to enable this new area of industry.