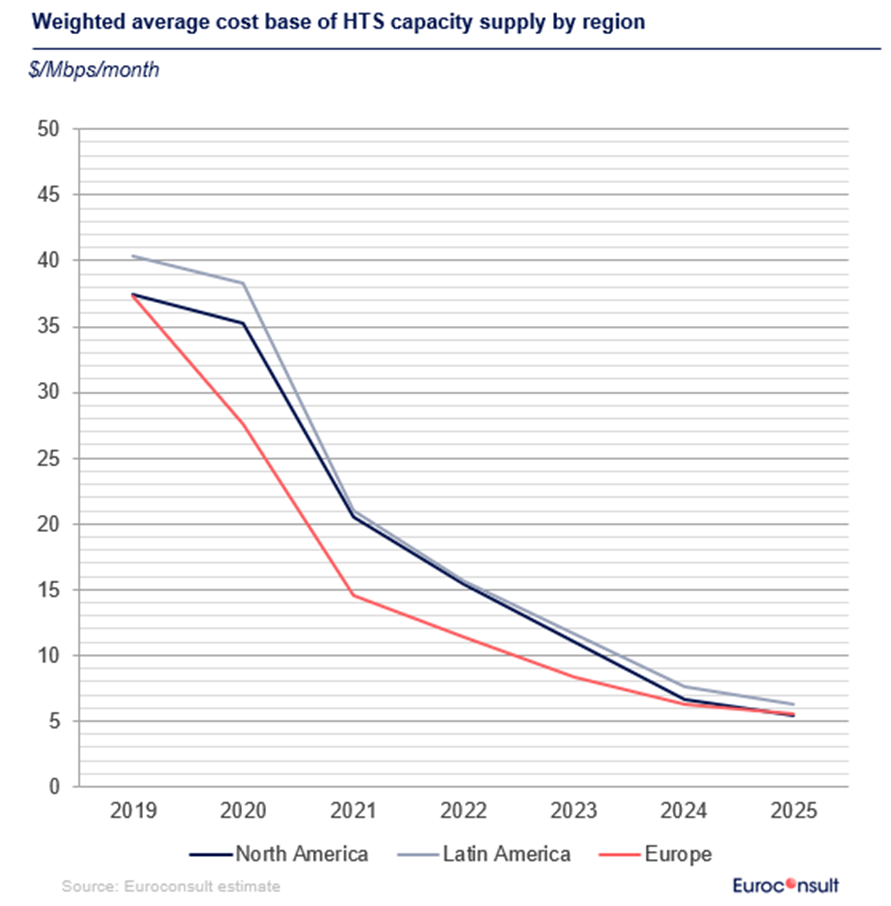

Starlink has played a major role in driving down the cost of new satellite communications networks, according to a new report from Euroconsult. For more details, a chart is worth at least a thousand words:

What you’re seeing: This chart shows a measure of return on capital investment—essentially, how much it costs satellite operators to build network capacity. The dramatic decrease is largely driven by Starlink, according to Euroconsult’s Grace Khanuja, but also other modern spacecraft that are now cheaper to build and launch.

As a result, the cost of data from space has fallen 77% since 2019. The commodification of space data is changing the business, and with more non-geostationary networks coming online in the years ahead and more high-throughput satellites headed to orbit, that trend is unlikely to change.

Khanuja expects satellite operators to respond by vertically integrating, taking on more network management work from service providers, and providing value-adds like cybersecurity services, cloud computing access, and IoT packages.

The big but:… Satellite operators still face limitations such as market access rules, which keep NGSO networks from using all their global capacity. Some customers still perceive higher-latency geostationary satcom as being more reliable than networks based in the increasingly crowded orbits closer to Earth.

Citable stat: Before 2021, consumers paid between $2 and $5 per GB of satellite data each month. In 2023, the price ranged from $0.2 to $1.5. Who says deflation is impossible?