A one-time titan of the space industry finds itself on the sidelines, plagued by ballooning costs and slow timelines in its space division at a time when price and speed are king.

Boeing’s ($BA) earnings release this week rightly focused on trouble with the 737 Max, which drove the company to report a $773M loss in 2023 and suspend 2024 financial forecasts. The company’s space business was a footnote, but its future is equally uncertain.

- The company’s Starliner spacecraft, scheduled to carry a crew for the first time in April after years of delays, still doesn’t have an obvious path to recoup its cost overruns, which included an additional $288M in 2023.

- The ISS, which Boeing built and operates for NASA, is set to retire in 2030. Boeing isn’t the prime for any of the commercial stations vying to replace it, but plans to support Blue Origin’s Orbital Reef.

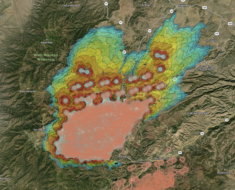

- Boeing lost $315M due to problems with the mPower satellites it built for SES; it’s now building two more and fixing the problems with the rest—at cost. At a time when satellite manufacturers are pushing speed, Boeing delivered 10 spacecraft in the last three years, and hasn’t won any of the SDA’s billions of dollars in new satellite orders.

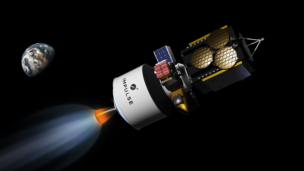

- The company’s Space Launch System rocket is the centerpiece of the Artemis lunar return program, but those missions keep getting delayed—and the massive rocket’s price tag makes it a constant target for cost-cutting.

- With United Launch Alliance up on the auction block and Boeing reportedly not among the bidders, it looks likely to lose access to the commercial and military launches.

The bottom line: Boeing’s iconic space division—which does boast the X-37B, the US military’s favorite semi-secret space drone, and which won a $500M Space Force missile tracking contract in December—has suffered not just from its own troubles, but the company’s recent years of losses. Keeping up with traditional rivals and new entrants alike demands investment the company just can’t prioritize.