(Editor’s note: This is Payload Research analysis. Claire Stevlingson contributed to the article)

Out are the days of onesie twosies large GEO satcom birds, and in are the mega-constellations in LEO, consisting of an army of hundreds or thousands of smaller satellites that provide ultra-fast connectivity.

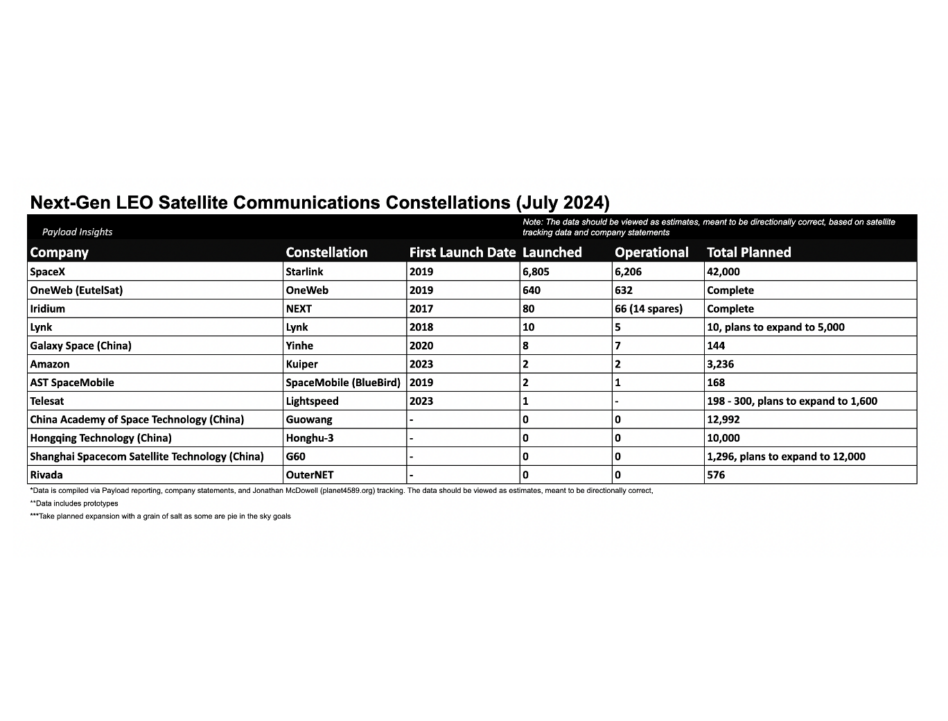

The data for the table below was compiled from publicly available information, Jonathan McDowell’s satellite tracking data, and directly from companies. Given the difficulty of pinning down operational satellites and planned constellation sizes (these are often loose goals set by CEOs), the numbers listed below should be considered directionally correct. Importantly, this is a select list of constellations, not an exhaustive list.

LEO satcom can deliver 100+ Mbps connection, compared to GEO satcom’s ~20-30 Mbps download speeds range. While 20-30 Mbps is enough to do almost anything on the internet, the difference in speed is noticeable to the consumer.

Take the now universal frustration of dealing with lag or coverage outages on a plane while trying to get some work done. How quickly we lose sight of the remarkable technological achievement of having any connectivity whatsoever at 30,000 feet. We are creatures of comfort, and a seamless internet experience is now expected.

Market size: We believe the market and economics of LEO satcom are robust enough to support multiple mega-constellations.

- The connectivity market is one of the largest in the world. Large swaths of the world remain unconnected, and future tech needs nimble connectivity solutions, including specialized multi-orbit/direct-to-cell constellations.

- LEO satcom doesn’t just provide better service for existing customers, it’s high speed capability significantly expands the addressable market, bringing in new faces to the sector.

That being said, not all of the networks listed above will survive the next five to 10 years. It may even prove difficult for established players like OneWeb or Iridium to find the rationale to build their next constellation and compete with two well-funded behemoths.

The Constellations

Kuiper: Amazon launched its first two Kuiper prototype satellites with ULA in late 2023. The company has booked 80 heavy lift launches with Blue Origin (New Glenn), ULA (Atlas V/Vulcan), Arianespace (Ariane 6), and a recent 3-launch deal with its arch nemesis SpaceX (Falcon 9). Amazon plans to invest $10B in the constellation.

Work is well underway.

- The company’s Kirkland, Washington manufacturing facility opened in April and can support a daily production rate of five satellites.

- The manufacturing blitz is driven by an FCC mandate that the company must deploy at least half its planned 3,236 satellite constellation by summer 2026.

The limiting factor for hitting that deployment rate will likely be launch, not funding or satellite manufacturing. The first batch of Kuiper satellites is slated to launch in Q4 aboard Atlas V. However, Kuiper’s other rides to space—Ariane 6, Vulcan, and New Glenn—face delays and an uncertain launch cadence ramp.

The Kuiper team consists of numerous former SpaceX employees, including itspresident Rajeev Badyal. Once fully deployed and operational, we expect the mega constellation to provide *similar* speeds and capability as Starlink.

To penetrate markets, especially the US where the Starlink service can costs $100 per month,Amazon will likely leverage its proven strategy of undercutting competitors on price to gain an edge.

But why?: Amazon is five years behind SpaceX, so why are they choosing to make LEO satellite communications one of their largest infrastructure bets ever?

Here is how Amazon puts it:

“Billions of people around the world don’t have reliable access to broadband…You don’t have to travel far from major cities to lose internet connectivity—it can happen within a 60-minute drive from Amazon’s headquarters in Seattle. Cost, complexity, and geography can make it difficult to install traditional, ground-based fiber and wireless connectivity solutions in these areas. Satellite broadband can fill many of those coverage gaps.”

Starlink: SpaceX has deployed over 6,000 satellites in its planned 42,000-bird constellation. As of May 2024, the service has signed up over 3M customers and is available in 100+ countries.

- We forecast Starlink will generate ~$7B of revenue in 2024.

- New product designs like the Starlink Mini and DTC capabilities will continue to support growth, with the company is racing towards 10M users over the next few years.

- With a shorter lifespan (only ~5 years per satellite compared to about ~15 for Iridium), SpaceX will have to continuously replenish its constellation to maintain coverage. This impacts profit margins but ensures the constellation will always feature state-of-the-art technology.

SpaceX builds its Starlink satellites for just a couple hundred thousand dollars a pop and leverages low cost to orbit rides on Falcon 9, enabling the service to achieve breakeven cash flow.

Iridium: Since the late 90s, Iridium has been a stalwart global satellite connectivity provider. Prepared for the LEO opportunity, in 2017, Iridium began deploying its NEXT constellation.

- The NEXT constellation deployment completed in 2019 and includes 66 operational satellites plus 14 in-orbit spares.

- The core services include voice, data, IoT, and government connectivity, which the company insists are generally companion/supplementary/backup services rather than broadband, allowing it to coexist with Starlink and AST SpaceMobile’s Blue Birds.

- The company’s revenue totaled $791M in 2023, growing 10% year-on-year.

Subscription cash flow has been used to buy back $819M of shares and pay a 2% dividend. The company plans to return an additional $3B to shareholders by 2030.

OneWeb: Last year, OneWeb (LEO) merged with Eutelsat (GEO) to offer multi-orbit satellite connectivity and compete with the Starlink constellation. OneWeb is expected to bring in between $150M and $250M in revenue for 2024. The company has loose plans to refresh its network with a next-gen $4B constellation before the end of the decade. However, management is seeking alternative ways to finance and reduce investment for the build-out.

AST SpaceMobile: The direct-to-cell service has had one heck of a year. The company signed customer and funding partnerships with the two largest US wireless carriers, Verizon and AT&T, and announced its first five commercial satellites are ready to launch this September. The string of positive news has sent the stock ripping, up 275% this year to a $5B market cap.

Lynk: Lynk is another direct-to-cell business. The company operates five satellites in orbit with plans to increase the constellation size to over 70 by the end of next year. In a prospectus for its SPAC merger deal, management declared plans to increase the constellation size to 5,000—a pie-in-the-sky goal, given the increasingly crowded market and limited deployment thus far.

Rivada: Rivada burst onto the scene in 2022, signing a $2.4B contract with Terran Orbital to build its satellite constellation. The contract always seemed peculiar, given that Rivada came out of left field with little insight into how or who would fund this mega-project. Two years later, we still know very little about Rivada’s funding mechanism. Although Terran Orbital insists the company is current on its milestone payments.

Telesat: Canada’s Lightspeed constellation’s first commercial birds are slated to launch in 2026, with service beginning in 2027. The service will focus on secure comms for enterprise and government customers.

A note on China: China is in the early stages of developing large LEO satcom constellations. The first satellites of the 12,000-strong G60 constellation are set to launch later this summer, as the first batch of Guowang satellites awaits its flight date.