President Donald Trump’s first term was a boon for the space industry. His first administration reestablished the National Space Council, created closer ties between the commercial sector and civil decision makers, attempted to streamline launch and reentry licensing requirements, and stood up the Space Force. So, it’s no wonder investors were bullish on a second term.

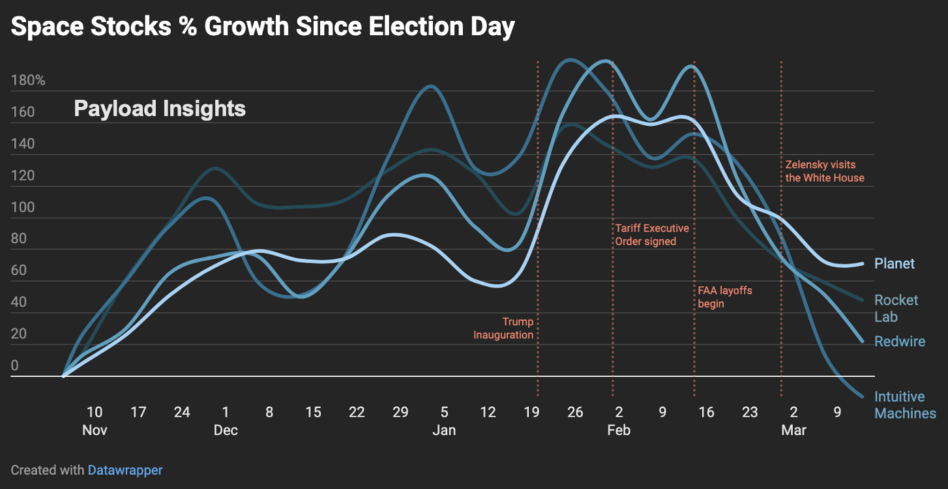

Space stocks soared in the wake of Trump’s election win. By Inauguration Day, four of the largest space stocks by market cap had doubled in value on the expectation that Trump would continue the progress made in his first term.

Enter reality: During his inauguration speech, Trump highlighted his determination to put US boots on Mars, and “pursue our manifest destiny into the stars.” Space stocks flew even higher.

In the weeks since, however, many of these lofty valuations have come crashing down. So what’s changed since January? It’s safe to say the contraction has been driven, at least in part, by the broad uncertainty brought on by the new administration.

- A new agency tasked with dismantling the government bureaucracy—headed up by Elon Musk—has put federal employees on edge and raised questions about competition for federal space contracts.

- Mass layoffs at agencies that maintain, fund, and oversee the space industry have also created doubts about the capability of US companies to win contracts and meet their launch goals.

- Tariffs threatened, delayed, and imposed created confusion and volatility that drove investors toward liquidity.

“Instability is a nightmare. If you don’t know what’s happening, you can’t plan, you can’t execute, you can’t do anything. Right now the feelings I’m getting are, ‘I don’t know what I’m supposed to do,’” said Phillip Gulley, the cofounder and chief strategy officer of Cofactr, a supply chain risk management company.

Business not as usual: For the most part, the space industry is following broader market trends. Between Election Day and Trump’s inauguration, the S&P 500 rose ~5%. Since the inauguration, it’s fallen nearly 10%.

The sudden fall of space stocks revealed how exposed the space industry has been to the multiple strains of uncertainty brought on by Trump policies.

- In February, space stocks began to dip as Trump outlined his proposed tariffs on Canada.

- They began to spiral downward after government layoffs focused on the FAA became reality.

- They dove further when Trump’s tensions with Ukraine and other allies started to raise questions about US defense funding.

- Most recently, they fell even lower once tariffs against Canada came into effect.

For Intuitive Machines the fall into the negative came in the wake of the company’s second lunar landing, which tipped over on the surface of the Moon. Sometimes certainty can be bad for business too.