Two top American SAR operators said proposed reductions to export restrictions on the radio frequency of tech sold overseas don’t go far enough—and that US firms will lose international business if the government sticks to its plan.

How we got here: The State Department requested comments in October on a proposal to make changes to the International Traffic in Arms Regulations(ITAR). While the window for input from industry was expected to close last month, State extended the comment period through Dec. 23 after companies asked for an extension, according to Frank Baches, CEO of Capella Space.

“I believe that if these regulations remain in place, we will actively lose out on deals,” Todd Master, Umbra’s COO, told Payload. “The default is to go to the Europeans because they don’t have export restrictions.”

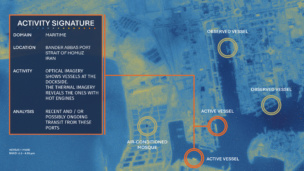

South Korea is working with France’s Thales Alenia Space on its planned constellation of SAR sats and the German Ministry of Defense is working with ICEYE, a Finnish company, to supply SAR imagery to Ukraine.

The problem: Existing restrictions limit exported sensors to 300 MHz—which produces slant resolution imagery about equal to a .5m, though resolution is governed by NOAA. The proposed change would increase that to 500 MHz—a benchmark that is not commercially relevant because it would produce lower resolution images than what’s available on the market, according to officials from both Umbra and Capella, who have not gotten an answer from the government on how the 500 MHz number was selected.

“The way it’s written right now, I could not export a system that’s actually relevant to them,” Master said. “I would have to develop a less capable system to export.”

US firms are instead arguing for a 1,200 MHz limit in the export regulations, which is in line with capability being offered by international companies, they said.

What’s next: The companies are now hoping that the momentum to debate and ultimately update the rules continues amid the shift in administration—something that Master called “a little bit of a leap of faith.”

Incoming President-elect Donald Trump in general is very supportive of American-made goods. As a result, Backes predicted the climate for exporting US tech “will continue to be positive.”

“I do anticipate the new administration coming in is going to be interested in export control and focused on US manufacturing being able to be exported to the rest of the world,” Backes said.