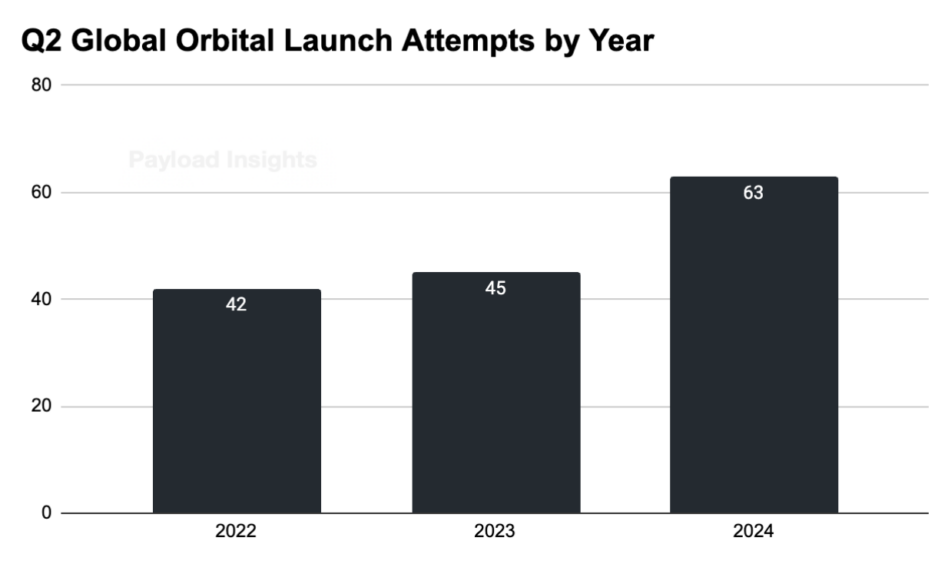

There were 63 total global launches in Q2 2024, a 40% YoY increase. The usual suspects, SpaceX and China, are once again leading the charge.

SpaceX launches continue to climb higher and higher each quarter, with the company targeting a dizzying 148 Falcon launches this year. Considering booster reusability and an insatiable demand for Starlink launches, the limiting factors for the 148 launch goal are port congestion, weather, and the speed at which SpaceX can manufacture its expendable second stage.

Rocket Lab: Rocket Lab doubled its Q2 launch cadence YoY. The four flights included two NASA PREFIRE missions.

ULA: ULA’s two Q2 missions held historical significance: the final Delta IV Heavy flight and the first crewed Starliner mission. We are all (perhaps also including the mysterious ULA suitor) awaiting Vulcan’s second flight (Cert-2).

- Due to delays with Sierra Space’s Dream Chaser space plane, Tory Bruno was forced to push back Cert-2 to Q3 and swap the flight payload to a mass simulator.

- The now non-revenue-generating mass simulator flight may be a $100M punch to the gut, but it’s well worth it. A successful flight would allow ULA to move forward with the highly lucrative DoD NSSL launches, which require this second certification flight.

It was a quiet Q2 for just about everyone else. North Korea attempted to deploy a recon sat but failed catastrophically in a midflight ka-boom. Europe once again put up a goose egg for the quarter as it targets an Ariane 6 maiden launch in the next couple of weeks.

SpaceX launched 36 Falcon missions in Q2 2024, bringing the total for the first half of the year to 67 flights.

Falcon launches by month:

Jan: 10

Feb: 9

Mar: 12

Apr: 12

May: 14

Jun: 10

Launches slowed in June, although VP of Falcon Launch Vehicles Jon Edwards said last month, “We still have a good shot at 148. In fact, we may even try to do a few more this year.”

Q2 payload highlights:

- The DoD missions include two NRO spy satellite launches.

- SpaceX flew two ESA missions (government), deploying the EarthCARE cloud monitoring satellite and two Galileo navigation birds.

- The company flew its Bandwagon rideshare mission to a 45-degree inclination for the first time.

Starlink %: Starlink-dedicated missions as a % of total launches continue to increase. In Q2, 75% of SpaceX Falcon missions were Starlink, which is elevated compared to the last four years. Nonetheless, from a total launch volume perspective, SpaceX is still on pace to blow past its record for customer launches this year—a healthy sign for the industry.

Starlink-dedicated missions as a % of total launches:

2020: 54%

2021: 55%

2022: 56%

2023: 66%

YTD 2024 (June 30): 70%

Key takeaways:

- Deal sizes were comparable to Q1

- Four of the top five deals were international

- European launch was well funded with PLD, ISAR, and Orbex pulling in a combined $175M in Q2.

- For the second consecutive quarter, there were no significant US launch or spaceflight fundraises.

- Varda was able to secure a sizable Series B after successfully manufacturing crystals in space and safely transporting them back to Earth.