(Ed. note: This is Payload Research analysis. You can sign up for our Research newsletter here.)

Late last year, the World Radiocommunication Conference (WRC-23) approved a proposal to review EPFD (Equivalent Power Flux Density) limits, a critical juncture in rights negotiations between GEO and LEO operators that sets the stage for regulatory action by 2027 or 2031.

EPFD 101: At its core, EPFD measures the strength of satellite radio signals to ensure that the thousands of LEO birds don’t interfere with GEO systems.

The EPFD fight pits the new guard (the likes of SpaceX’s Starlink and Amazon’s Project Kuiper) against the old guard (the likes of SES and Viasat).

- New LEO companies say the future is now and current EPFD limits that were designed to protect GEO signals are outdated and spectrally inefficient.

- GEO operators contend that the existing rules provide essential protection for their systems to exist—systems that provide vital internet connectivity to millions of users.

Regulation is meant to adapt to changing markets. We see the reconsideration of EPFD rules as an important step in supporting the significant user growth in LEO. Nonetheless, regulators will have to manage this GEO to LEO shift while safeguarding established GEO systems.

Spectrum Regulation 101

Internationally, spectrum rights are governed by the International Telecommunications Union (ITU).

Space spectrum: Spectrum for space is shared among a wide variety of companies, posing unique coordination challenges.

- LEO satellites operate much closer to the ground and far outnumber GEO birds.

- Systems in different orbits must operate without causing interference to each other.

- Since LEO birds do not have a fixed location, it is harder to evaluate their interference impact than the impact of fixed-location GEO satellites.

That is where EPFD comes in.

EPFD architecture: EPFD limits evaluate the signal strength of satellite uplinks and downlinks to ensure that the aggregate power density stays within the safe levels needed to prevent interference with other systems.

History of EPFD: The idea of EPFD limits emerged in the 1990s during the design phase of the first non-GEO birds, such as SkyBridge and Teledesic. Given GEO systems were the predominant satellite communication systems at the time, operators were reluctant to risk their operations for untested LEO systems. The following key concerns were raised:

- A non-GEO system with priority could potentially block future GEO deployments.

- Achieving coordination with all existing GEO systems without causing unacceptable interference was challenging.

The solution was a new regulatory approach adopted in 1997 that defined “acceptable interference.”

This architecture, known as EPFD, leveraged antenna directivity and changing geometries to manage interference. Non-GEO systems operating within this acceptable interference envelope would need less coordination with GEO providers.

LEO Operators Chime in

EPFD critics: LEO operators have long criticized EPFD limits as overly conservative. They argue that these limits were established when non-GEO systems were still conceptual, resulting in regulations that disproportionately benefit GEO operators.

SpaceX: “This inefficiency unnecessarily constrains the ability of non‑GSO systems to meet growing demand from consumers for high-speed, low-latency broadband, without providing any additional protections for legacy GSO satellites,” said SpaceX VP David Goldman.

Et toi, Kuiper?: “EPFD limits formulated nearly 25 years ago when non-GEO technology was new are outdated. Satellite technology and spectrum management principles have changed a lot since then, but the rules haven’t kept pace,” said Amazon Kuiper executive Julie Zoller.

They have a point. A lot has changed since EPFD rules were introduced. LEO is no longer a fringe domain. The market has flipped on its head—operators have ditched investing in new GEO satellites en masse, and now nearly every satellite operator is focused on building in LEO.

GEO falloff: New GEO satellite orders have collapsed, rendering the market almost nonexistent. So far this year, operators have ordered just three GEO birds—two of them are small Astranis satellites, which are unique in that they offer targeted GEO service.

- However, for operational GEO satellites, the market is very much alive, presenting a conundrum for regulators.

- GEO birds are high-revenue-generating systems providing high-quality internet to millions of people around the world.

Why decide when you can bide time?: How do regulatory bodies protect the fleet of important and long-lasting GEO birds? They bide their time.

It looks like EPFD rules will change by 2031 (although some argue that a change by WRC-27 is still possible). The four to eight year timeframe allows LEO to mature further before the change that benefits lower orbits is made.

Benefits of relaxing EPFD rules: One key argument for revising EPFD rules is that it hampers optimal spectrum utilization in an increasingly crowded environment.

A relaxation of these limits would grant LEO operators more operational flexibility, enabling:

- Increased capacity

- Improved customer access

- Reduced slowdowns and outages due to high demand

Additionally, operating satellites at higher power can lower user equipment costs, broadening connectivity access.

While there is no straightforward metric for capacity increase or availability, the overall impact should be meaningfully positive for expanding satellite connectivity.

Starlink/Kuiper/OneWeb: The increased internet speeds for LEO constellations (Starlink, OneWeb, Amazon Kuiper) would help close some of the performance gap with fiber and thus catalyze further demand.

LEO vs. GEO

The ITU’s primary goal is global connectivity, and regulatory changes aim to support this objective. Significant investment in LEO systems and the operational success of broadband LEO satellites like Starlink and OneWeb have shifted the connectivity focus from GEO to LEO.

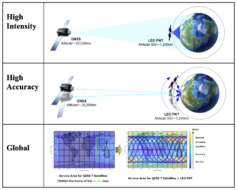

Both LEO and GEO systems provide unique benefits and in many ways complement each other, as seen by numerous constellations adopting a multi-orbit approach.

There is broad consensus that the EPFD rules need updating to reflect technological advancements and improved spectrum-sharing techniques—but interim coexistence (and need to promote) both GEO and LEO systems is also crucial for optimizing global connectivity.

(Argyris Kriezis contributed research to the article).